Talking Points

- Gold Prices are Set to Close Higher for 5th Day

- Next Resistance Resides at 1,291.76

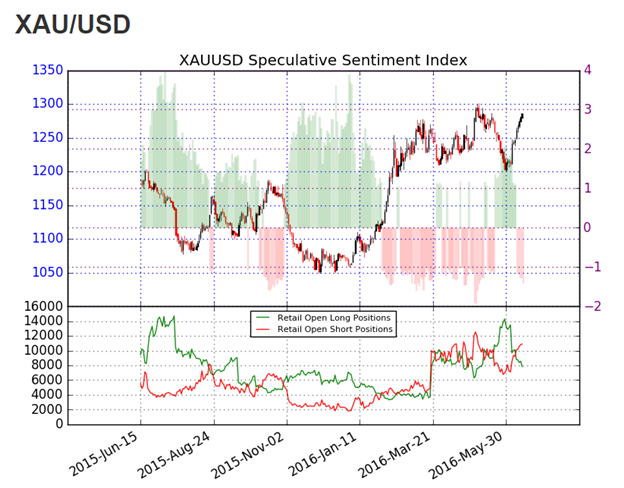

- Sentiment readings remain negative, with SSI set at -1.33

Gold Prices are trading to new monthly highs today, and price action is set to close higher for the fifth consecutive trading session. This move has been predicated on the idea that that tomorrow’s event will yield no significant changes in monetary policy from the Fed. Expectations are for key interest rates remain at 0.50%. However, a surprise hike or a change in rhetoric from the Fed may have drastic effects on the US Dollar as well as Gold.

Looking for additional trade ideas for Gold? Check out our Gold Trading Guide

Gold 4 Hour Chart

(Created using Marketscope 2.0 Charts)

Technical traders should note that next resistance level for Gold prices resides at 1,291.76. This area has been identified as an 88.6% Fibonacci retracement, which has been measured between the May 2016 high and the monthly low. If prices trade through this value during tomorrows trading, it would be another strong signal that the current bull trend in gold is set to continue. In this scenario, traders should then look for Gold prices to challenge the previous swing high located at 1,303.62.

Alternatively, if the US Dollar begins to rally during tomorrows FOMC event, traders may look for a decline in Gold under resistance. A breakout lower would be significant as it would suggest that Junes rally was nothing more than a retracement and allow prices to test key values of support. Areas of support may include 1233.98 as well the May low at 1,199.55.

Why and how do we use SSI in trading? View our video and download the free indicator here

SSI ( speculative sentiment index ) for Gold (Ticker XAU/ USD ) continues to slowly move toward extremes. Last week we reported that SSI read at -1.10, but now the index has shifted further short reading at -1.33. With 57% of positioning currently long, this reads as a marginal bullish bias for Gold. In the event of a breakout above resistance, SSI should continue to push towards a negative extreme. Alternatively, in the event that resistance holds, and Gold traders lower, it would be expected to see sentiment shift towards a more neutral value.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guide to find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.