Talking Points

- EUR/USD Rebounds After ADP Employment Numbers Beat Expectations

- Historical Bearish Price Distributions Begin at 1.1078

- If you are looking for more trading ideas for the Euro , check out our Trading Guides

The EUR/ USD is trading higher after ADP Employment Change numbers for June beat expectations. These figures were expected at 160k but were released at an actual 172K. After a momentary dip in price action, the EUR/USD has now rebounded and is trading just beneath 1.1100. Not only is this value acting as a whole number of resistance for the pair but it is also currently acting as an area of trend line resistance.

EUR/USD, 30 Minute Chart

(Created by Walker England)

As prices trade toward 1.1000, traders may continue to monitor short term momentum for the EUR/USD. Displayed in the 3-minute chart below, the EUR/USD has been trending higher. The GSI indicator has noted this short-term upswing in price, by highlighting a series of higher highs that have printed since this morning’s news event. After reviewing 49,077,822 pricing points, GSI has indicated that price action has advanced a minimum of seven pips in 52% of the 189 matching historical events.

This has been followed by an additional 8-pip rally in 29% of historical instances. Traders looking for a return to the early bearish market conditions should watch for a move to the last historical bearish distribution found at 1.1054. A move to this value would represent a decline of 40 pips, which occurred in 7% of matching events.

Want to learn more about GSI? Get started learning about the Index HERE.

EUR/USD 3 Minute GSI Chart

(Created by Walker England)

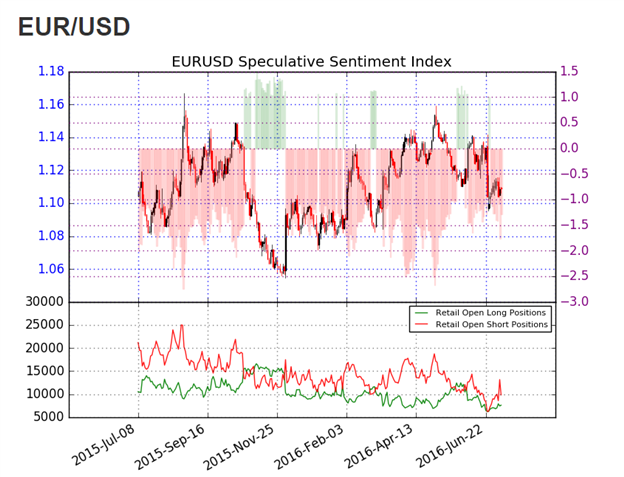

Sentiment for EUR/USD is currently negative, with SSI ( speculative sentiment index ) reading at -1.27. With 53% of positioning long, SSI has a slight bias towards a EUR/USD decline. In the event of a further price decline, traders should look for SSI to extend to a negative extreme of -2.0 or less. Alternatively, in the event that the EUR/USD trades higher, traders should watch for SSI to neutralize and potentially flip towards a positive reading.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.