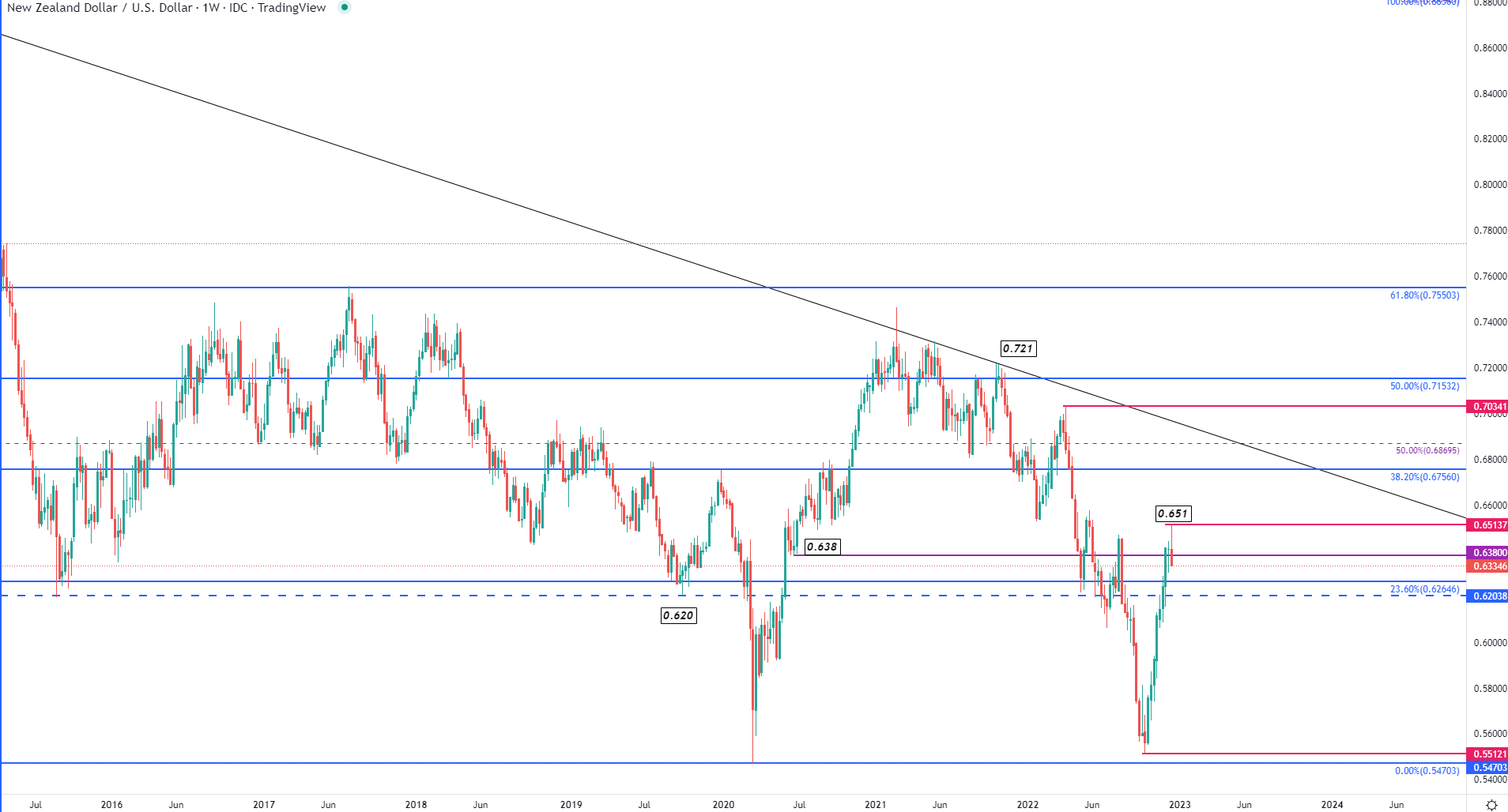

In the wake of higher interest rates and slowing growth , the safe-haven Dollar gained against most major counterparts before losing traction in Q4. With the strong greenback driving NZD/USD to a low of 0.551 in early October, expectations of a Fed pivot fueled a rebound which allowed Kiwi to retest 0.65.

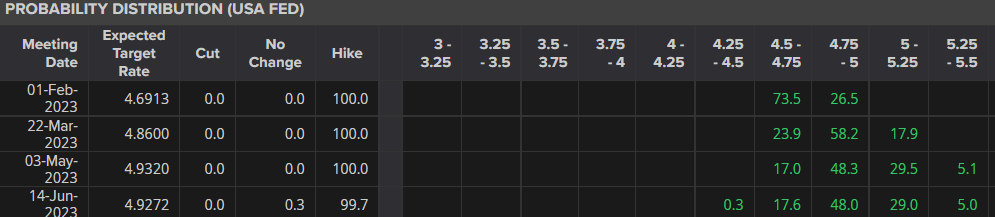

Despite a softer 50 basis point rate hike being announced at the December FOMC , commentary from Jerome Powell suggested that interest rates will likely remain elevated for the duration of 2023.

Although this rhetoric continues to support US Dollar strength, the next quarter could see the New Zealand Dollar outperform in this regard.

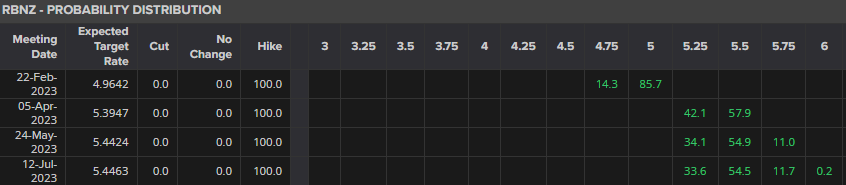

While both major central banks remain committed to taming inflation through restrictive monetary tightening, RBNZ (Reserve Bank of New Zealand) is expected to continue hiking at a more aggressive pace.

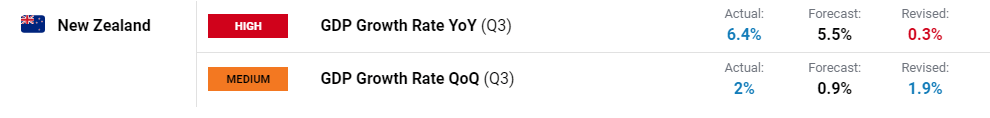

For the New Zealand economy, recent GDP figures suggested that growth remains robust which could allow the Central Bank to continue to tighten further.

In Q1, 2023, recession risks, inflation and China’s reopening will likely assist in driving the broader economic outlook.

If NZD/ USD can gain traction above 0.65, further upside momentum could drive Kiwi back towards mid-point of the 2009 – 2011 move at 0.687. If this zone of resistance is broken, it could be possible for the pair to retest the April 2022 high at 0.703.

NZD/USD Monthly Chart

Chart prepared by Tammy Da Costa using TradingView

However, as the weekly chart highlights additional zones of support and resistance that could contribute to the next quarter’s move, imminent support holds at 0.620. If NZD/USD breaks below this zone, it is possible for prices to experience further declines.

NZD/USD Weekly Chart

Chart prepared by Tammy Da Costa using TradingView