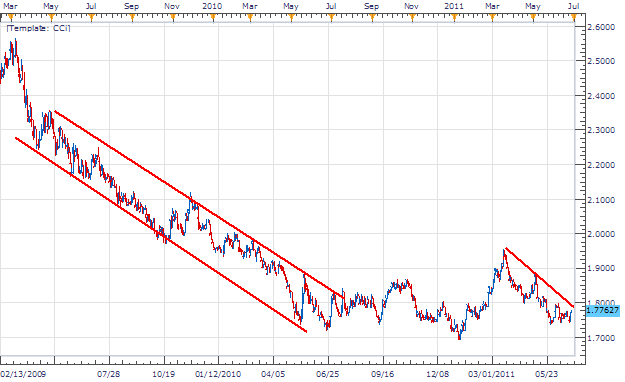

The EUR/NZD has been one of the markets most trending pairs, channeling downward from its February 2009 high at 2.5804. Since this time, the pair has moved 8,888 pips in the past 17 months carving out a current low of 1.6921 in January of this year. Price is currently consolidating against the low allowing us chances to join the trend.

Fundamentally, the Euro is still under fire regarding the potential for a potential default of Greek debt obligations. This currency has made the Euro weak across the board specifically against commodity and high yielding currencies such as the Kiwi . As the fundamental projection has not changed since our last update, it is reasonable that our trend is set to continue.

Price Action

Taking price into a 4H chart, we can see price testing our resistance line near the 1.7800 level. Currently price has tested this trend line three times with the EUR/ NZD to yet form a higher high. This signifies that our downtrend is to continue until resistance is invalidated by a breakout. CCI (20 periods) has helped confirm the pull back against the trend and is turning and is currently crossing back below the +100 mark on our indicator.

Trading O pportunity

My preference is to sell the EUR/NZD pair against resistance at 1.7800. CCI (20 periods) will be used as our trigger and an entry will be made once our indicator crosses below the oversold value (+100). Stops should be placed over the previous high near 1.8030. Profit targets should be set at 1.7340 or better to give a clear 1:2 Risk/ Reward ratio.

Alternative scenarios include price breaking higher and invalidating our current downtrend.

Walker England contributes to the Instructor Trading Tips articles. To receive more timely notifications on his reports, email [email protected] to be added to the distribution list.