The EUR/AUD has been a contestant staple for trend traders moving downward for nearly three years from its 2008 high at 2.1114. The pair continues to grind lower, recently creating a monthly low on July 12th at 1.3104. As price temporarily retraces against the trend on our shorter time frames, traders can wait patiently looking for a breakout in the direction of the overall trend.

This week we have seen the Euro gaining ground against many of the major currencies around the globe. This change of pace has been brought largely on the fact that EU leaders are finally looking to back a new bailout plan for Greece . The Aussie has stood out for maintaining its ground this week where other pairs have faltered. Money continues to flow to high yielding currencies, and the Aussie dollar has been the direct beneficiary. If this bias continues, we can reasonably expect our trend to continue as well.

Price Action

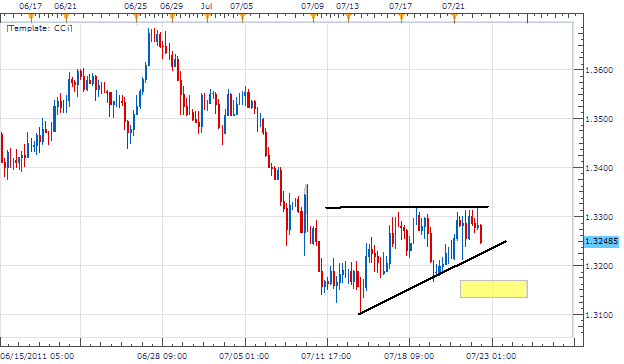

Moving to a 4H chart, we can see price consolidating at the bottom of our previous leg down in a triangle formation. Price is currently making an attack on support , currently residing at the 1.3225 level. Resistance is firmly overhead at 1.3318, drawn by matching up the highs from July 18th and 22nd. As price moves between these two points, traders can wait patiently anticipating a breakout with the trend.

Trading O pportunity

My preference is to sell the EUR/ AUD with the trend as price moves through support on a breakout. Entry’s should be placed under the previous low of 1.3163. Stops should be placed near the 1.3278 handle. Limits should target 1.2933 or better, setting up for a minimum return of 230 pips for a clear 1:2 Risk/Reward ratios.

Alternative scenarios include price breaking out above resistance at 1.3318.

Walker England contributes to the Instructor Trading Tips articles. To receive more timely notifications on his reports, email [email protected] to be added to the distribution list.