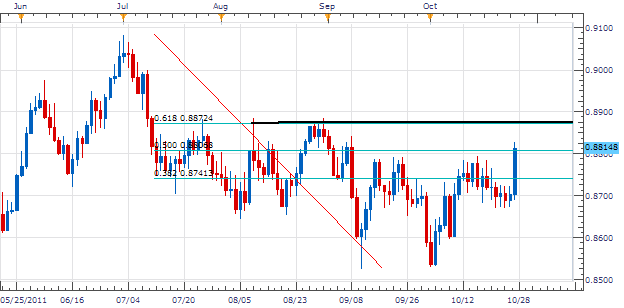

The EUR/GBP has historically been one of the pairs that historically contains less volatility and is known to develop into trading ranges. Currently the 2011 high resides at .9082 found on July 1st . The pair created a fresh low of support on September 12th at .8525. One way of finding support and resistance is by drawing fib retracements between these two points. Currently price is approaching our .618 retracement at the .8872 level forming our next line of resistance for the pair.

Fundamentally both pairs are normally affected by the same economic issues based off of their close geographic proximity. The Euro however, has had a recent surge in strength due to an agreement on how to tackle their sovereign debt crisis . While this affects the Eurozone greatly in the short run, ultimately the effects should benefit Britain and the GBP as well.

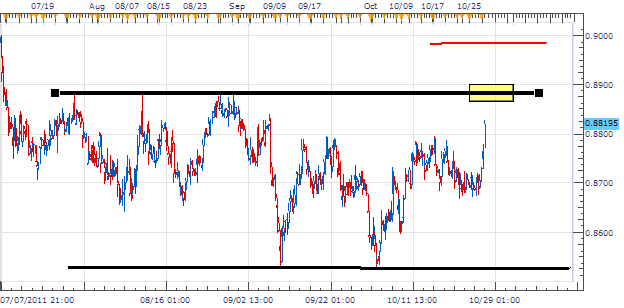

Trading a pricing range is an opportunity outlined once we have defined support and resistance. Resistance is outlined above at our .618 fib retracement near .8874. Support is found by matching up our Septermber 12th and October 3rd lows at .8525. Trading the range we can place entry’s near resistance and look for limits to turn back toward support. Further confirmation can be used by placing an oscillator such as MACD , CCI or RSI looking for a turn from overbought levels.

My preference is to place entry’s to sell the EUR/GBP next to resistance at .8888. Stops should be placed above resistance near the psychological .900 point. Limits should target the bottom of the range at .8540 for a near 1:3 Risk/Reward setting.

Alternative scenarios include price breaking through resistance and moving up to new highs.

Additional Resources

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].