The AUDUSD is at a fork in the road. A break below parity exposes several hundred pips to the downside over time. If the 1.0000 price level holds, an inverse head and shoulders pattern could possibly be playing out.

I’m trading based on a move below parity as a positive resolution to the European Sovereign Debt Crisis remains elusive. Therefore, we may be faced with a risk “OFF” environment and the AUDUSD may sell off. ( How to Read Risk “ON” or a Risk “OFF” Environment )

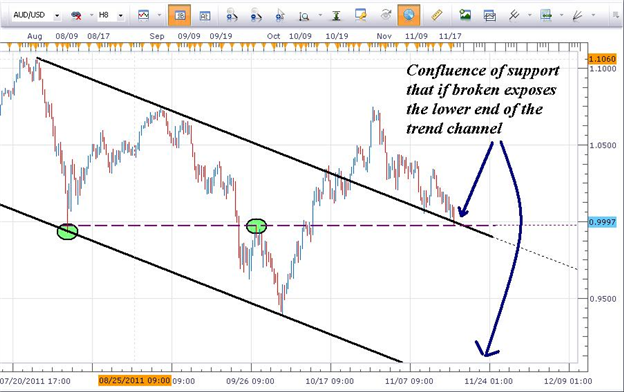

Round numbers tend to act like strong support and resistance levels on a chart and 1.0000 is considered a round number support level. In addition to 1.0000 providing support, there are 2 other support levels converging at the same price point.

A downward sloping trend channel (black line) was broken back in mid October 2011. Prices are now coming back and testing the topside of this trend line. Additionally, there is horizontal support (purple line) connecting several highs and lows in the past. The market has respected this 1.0000 level in the past so it has been an important level previously.

The stock markets are under pressure and may continue to fall. ( Dow Jones Industrials Pattern Similar to July 2011 ) It is probable to see a bounce here, but with the stock markets under pressure, this risk aversion may drag the AUDUSD lower. Lastly, any bounce may be short lived so I’m looking for selling opportunities on a clean break below 1.0000. Lack of a bounce will spell extreme weakness.

Additional Resources

How to Read Risk ‘ O FF’ or Risk ‘ON’ Sentiment

How a Stock Move Translates to Currency Trades (Text)

Identifying the T r end (Video)

---Written by Jeremy Wagner, Lead Trading Instructor, Education

Follow me on Twitter at @JWagnerFXTrader.