The GBP/USD has been the focus of today’s news as the BOE (Bank of England) decided to hold their key interest rates at .50%. This event is important to the market as the key rate will directly affect lending inside of the UK. With the news coming in line with expectations, the GBP / USD has failed to waiver from its current daily consolidating pattern .

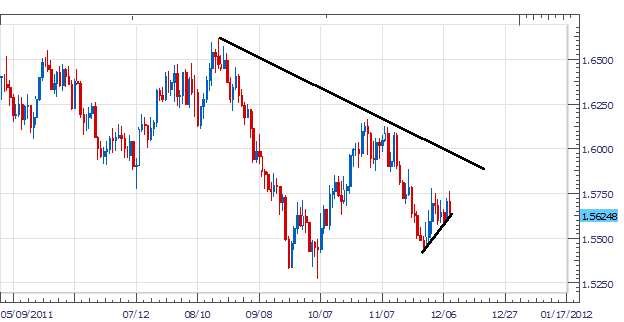

Currently our previous high remains at 1.6616, printed on August 19th.From this point, the GBP/USD moved 1346 pips lower, creating our current low at 1.5270 on October 6th. Price has consolidated between these two points for eight weeks now, leaving trend traders to move in on shorter term time frames to find market direction.

Taking Price in to a 1 Hour chart we can see support f form by connecting our previous lower lows. This support line gives us ample opportunities to buy in a short term uptrend with the indicator of our choosing. CCI is a great trading oscillator used to buy on dips. Traders will begin to look for the CCI indicator to dip below oversold (-100), then purchase as the indicator moves back above this level.

My preference is to buy the GBP/USD on a CCI crossover. Entrys should be near support at 1.5620 or better. Stops should be under support at 1.5585. Limits should target at minimum 50 pips for a 1:2 Risk/ Reward ratio. Secondary targets can be set near the previous high of 1.5750.

Alternative scenarios include price breaking lower through support.

Additional Resources

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.