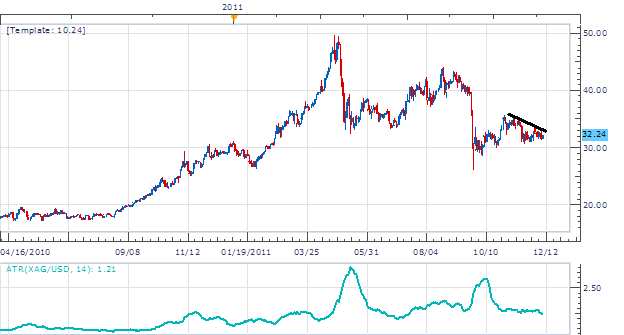

Silver has continued its steady decline by printing lower lows from its April 25th high of $49.78 an oz. However, since this high was printed volatility has also declined as measured by ATR . ATR is an indicator that is designed to help traders view the differences between assets high and low, and is often compared with price. At its yearly peak Silver was fluctuating over 7% of its price on a daily adjusted basis. Now, just seven months later this value has decreased by half. As volatility continues to slow, traders are left looking for new methods of trading a traditionally explosive asset.

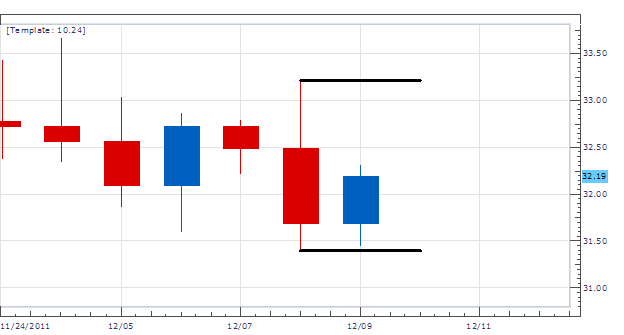

Zooming in specifically on the last two days (1D Chart) we can see the development of an inside bar. An inside bar occurs when today’s price action does not exceed either the previous day’s high or low of yesterday’s trading. Price action from yesterday printed a daily high of $33.21 and a low of $31.39. Today’s action has so far yielded a daily high at $32.32 and a low of $31.45, both inside of yesterdays levels.

Traders can use entry orders to trade a break of either the previous high or low. Expectations are that price will break and continue forming either a new high or low past this point. As described above, ATR is an indicator that shows current volatility levels and can be used for setting potential profit taking. I prefer using 20% of the current ATR for setting my limit orders while utilizing a 1/1 Risk/Reward ratio. Current ATR for silver resides at$ 1.21.A rounded 20% of this number resides at $00.25 presently.

My preference is to place entries on silver at the printed December 8th high/low. Both stop/limits will look for $00.25 for a clear 1:1 Risk/ Reward ratio.

Alternative scenarios include continuing to trade “inside”, prior to a breakout.

Additional Resources

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.