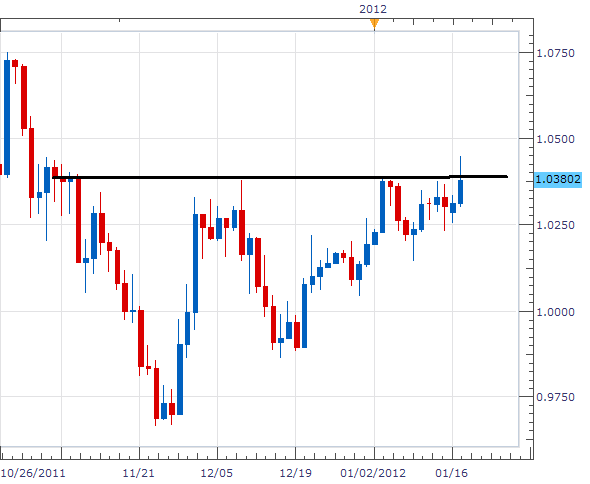

Today price action on the AUD/USD has pushed up to the 1.0380 resistance mark, as discussed in our previous “ Chart Of The Day ” .Traders viewing this chart may now wonder if price is prone to break to higher highs, or reverse. One tool we have in our trader’s toolbox is divergence. Traditional divergence can help traders identify points of reversal by comparing price to an oscillator such as MACD .

Bellow, we can see Traditional divergence begin to appear on the AUD / USD 2Hour chart by comparing our uptrend to the MACD indicator. Traditional divergence in an uptrend can be seen by first connecting swing highs on our graph. Today we are comparing the newly created AUD/USD high at 1.0451 compared to the January 3rd high of 1.0387. Connection these two points on our graph establishes a point of resistance, and a visual representation that a higher high has been created.

During the same time frame, we must compare the highs created on the MACD indicator. Since MACD is an oscillator, we would normally expect these points to follow price. As displayed, MACD is actually forming a set of lower highs, while price above is described as a higher high. This separation is the divergence we are looking for! For a further study on divergence, find my video presentation titled, “ The Diligent Divergence Trader” , linked here.

My preference is to sell the AUD/USD using traditional divergence. Traders may use a trendline break, oscillator crossover, or lower low to confirm entry. Entrys are expected to be near 1.0368. Stops should be placed over the previous high above 1.0450. Our limits should be set at 1.0250 or better for a clear 1:2 Risk/Reward ratio. Secondary targets can be set towards the December 28th low, at 1.0046.

Alternative scenarios include price forming a higher high, breaking resistance.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.