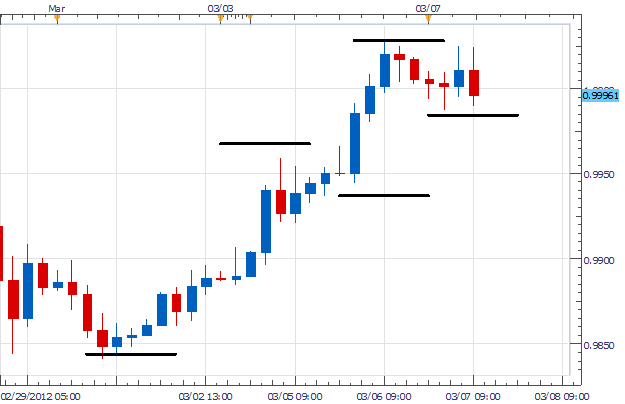

Below we can see the USD/CAD developing a steady uptrend on a 4Hr chart. From its monthly low at .9841, the pair has steadily risen in the last week of trading. A new high was created yesterday at 1.0027, equating to a rise of 186 pips over four trading days. Since this high has remained in place for a day now, directional based traders may use shorter term graphs to spot entrys with this longer term directional bias.

Moving from the 4Hr and dropping down to a 30 minute graph, is know as multi time frame analysis . Using this technique it becomes apparent that our trend has temporarily come to a halt. Price now appears to be trading in a range between the 1.0027 high mentioned above and the September 7th low at .9987.

Having a clear line of support is advantageous to both range and trend traders. Both plans of action will have similar methodologies and stop placements . Trend traders may take this pullback as an opportunity to trade a strong trend on a swing up from support looking for a higher high. Range traders may employ the use of an oscillator such as CCI and look for price to return to resistance. Regardless of the method chosen, stops should be set under our standing support line.

Can’t decide what route to use? Range or Trend? A third method of trading this move employs using two lots combining both of the aforementioned methods. Target one for our first lot will look for a price target at resistance near 1.0025. If the first lot takes profit, lot two can then be moved to break even and begin looking for a higher high.

My preference is to buy two lots on the USD / CAD under parity but as close to .9987 as possible, on a CCI crossover. Stops should be set under support near .9970. First targets should look for the top of the range at 1.0025. Secondary targets should be placed at 1.0055 or better in the event of a breakout to higher highs.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.