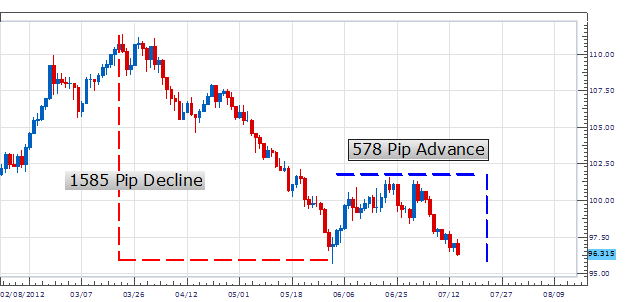

The EURJPY has been one of the strongest market trends for the 2012 trading year. Since its standing high inMarch at 111.43 the pair has declined as much as 1585 pips.As seen below on a daily graph, price has retraced as much as one thrid of this move, trading as much as 578 pips off the yearly lows at 95.58. Such a move against the trend can be difficult for trend followers to stomach. These traders have been forced to wait patiently and look for fresh clues of a return to downside momentum.

Hidden Divergence

One way to find a swing back in the direction of a long standing trend is by using hidden divergence. Hidden divergence is a method of comparing the separation of price and an indicator as they head in two different directions inside of a trend. Below we have an example of hidden divergence on the EUR / JPY 8hr chart using the MACD indicator. To spot divergence inside of a down trend, we need to begin our analysis by connect our previous and current highs marked on the graph. It is important to note when these points occur as we will next look at MACD for the same period.

Divergence can be pinpointed if the indicator is traveling in a different direction than price. If price is making a lower high as expected in a downtrend, for divergence to occur the MACD indicator should be printing a higher high. This is the hidden divergence signal trend traders will look for to see if the long stranding trend is to continue.

How to Trade Hidden Divergence

Once hidden divergence is spotted, traders may begin to spot entries in the direction of the trend. The easiest way to place trades is to use the oscillator already on the graph used to spot divergence. MACD traders, trading a downtrend, will look for the MACD line to cross below the signal line back with the direction of the trend.

Once a downtrend has resumed, aggressive traders may begin taking additional bearish crossovers using the MACD indicator. My preference is to continue to sell the EURJPY with the expectation of the creation of lower lows. Stops may be placed above the previous highs depicted above, with profit targets taken on the formation of new lows using a positive risk reward ratio of the traders choosing.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected] .

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.