It is the third trading week in July, and the Forex market has exposed further Euro weakness. Today we will review two of the markets strongest trending currencies, the EURJPY and EURGBP by applying our building blocks of scalping trends to 30minute charts. Ultimately, our objective is to identify the strongest market trends available for execution, while avoiding those that lack direction or momentum.

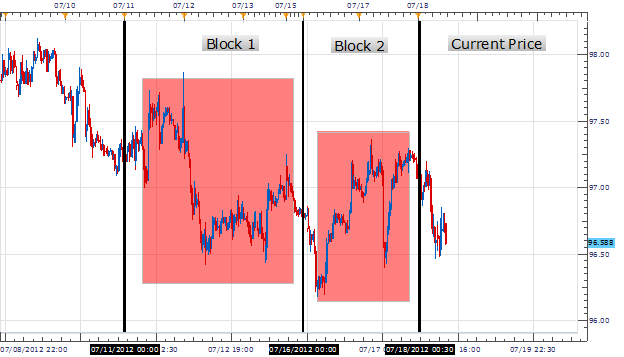

EUR JPY

EUR pairs still appear to be some of the strongest trending pairs in the market. Focusing on the EURJPY , the pair has declined as much as 171 pips from its Block 1 high at .9790. This move culminated in a fresh low for July pictured below at .9619 . Current price action has continued to move lower but has yet to form a lower low for our current price block. Due to this breakout traders are specifically watching this weeks price action to see if our trend breaks under the July 17th low at .9641. A break above our current Block 2 high at .9736 would signal at least a temporary end to downside momentum

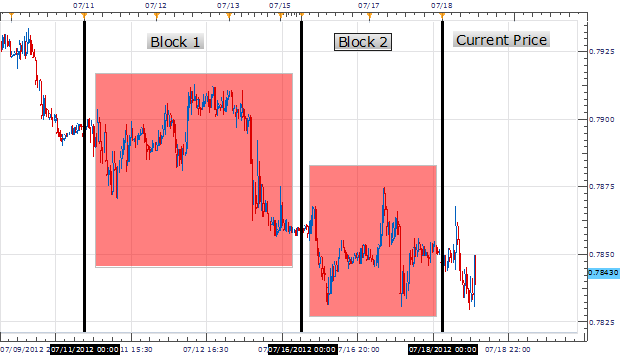

EURGBP

The EURGBP is also moving lower on general Euro weaknes. Depicted below on a 30 minute chart, the pair has declined a total of 84 pips lower from the July 12th high at .7913. This move is a strong continuation of Julys downtrend, with the last five completed blocks all pointing to the downside. Currently price is depicted testing a line of support at .7829. This line can be found by connecting our Block 2 and current pricing block lows . Trend traders will look specifically look for this weakness to continue. Any pullbacks in price or a breakout under support can be seen as an oportunity to enter fresh sell entries.

Using the analysis above, my preference is to continue to find opportunities to sell Euro crosses, primarily the EURJPY and EURGBP. Both pairs have the potential to breakout to lower lows if momentum continues to the downside. My preference is to sell the EURGBP on the creation of a new low under.7830.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected] .

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.