Article Summary: Would you like a simple tool based on recent price extremes to help you see the environment that you could help you prepare your daily trading plan? If so, the pivot range is a great tool that can show you hidden support and resistance, daily directional bias, and help you time great entries in the direction of the trend. This article will break down what this tool does and how to use it.

“The difference between successful traders and not-so-successful traders is what they do with the price data they all have, how fast they process the data, and then how they apply of execute that knowledge. Pivot points can give you the edge as fast as you can calculate the data.” John Person

Pivot points are a crucial part of any trading play. In a sense, they help you keep your head straight when volatility is high. This is done through the objective levels based on the high low and close of the prior session you’re trading to calculate this critical levels.

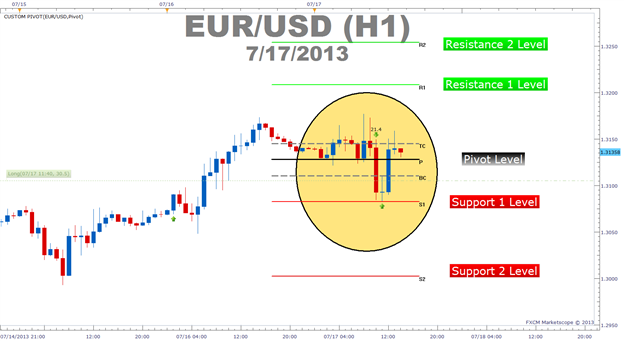

Learn Forex: Pivots As Seen On A Hourly EURUSD Chart

Taking Pivots a Step Further

As you can see, the daily pivots placed on the EURUSD chart provide objective levels for you to focus on if you’re trading the pair. Simply put, in a weak market, price will be trading below the pivot level and depending on the weakness; price can travel through multiple level of supports as price hits lower lows. In a strong market, price will be trading above the pivot level and depending on the strength; price can travel through multiple levels of resistance. In a mixed market, your opportunity will likely be found by price bouncing around the pivot and fading temporary moves.

The key point to focus on is where price is in relation to the pivot. When price is trending higher and trading above the pivot, we should be looking to buy dips and exit on strength near the resistance levels. When price is trending lower and trading below the pivot we should be looking to enter sell trades on temporary lifts in price while targeting levels of support if price resumes lower.

Pivot Range Intro

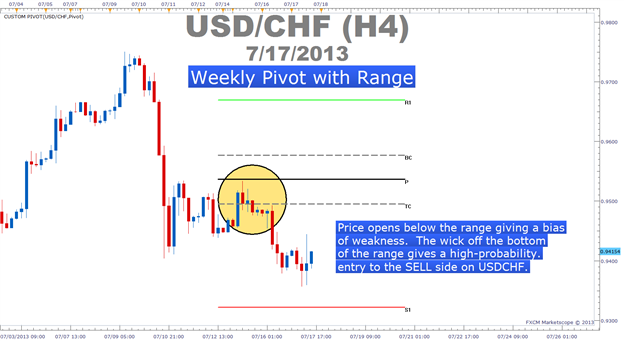

A relatively new concept is the Pivot Range which was introduced in the book, The Logical Trader by Mark Fisher . Fisher introduced some very good trading concepts but the Pivot Range has stuck with many traders because of how the range allows trader to focus on key price points before a continuation move. The range itself is meant to be a neutral point that helps you determine a directional bias so that you can focus on buy entries when price is above the range or sell entries when price is below the range.

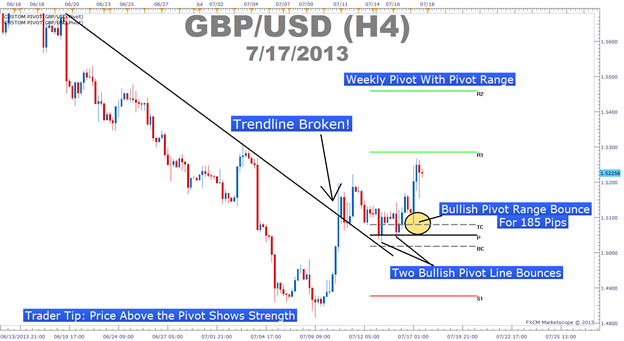

LEARN FOREX: Pivot Range Bounces Show Trend Continuation Entry Points

PIVOT RANGE CALCULATION

The reason why pivots are so helpful is that they are built off the most extreme prices of the prior session. The pivot range goes one step further to define the relationship of the high and low from the prior session to the current pivot. Therefore, beyond the traditional calculation for pivots, you can additionally calculate the High + Low / 2 of the most recent session you’re focusing on to get the bottom of the range. The top of the range is received by calculating the Pivot - Bottom of Pivot Range + Pivot.

Therefore, if you’re using a daily pivot, your range would be built around yesterday’s high + low / 2. These levels will now act as addition key areas of support and resistance to help steer your trading decisions. If price ever breaks through the pivot range, your bias for the next move should change as price in relation to the pivot should determine how you’re viewing the market as price is the most important indicator.

Free Indicator With The Calculation

Lucky for you, the calculation is available for free on an open source developer’s site.

Entry Triggers

You now know that the pivot range is an extra level of important price levels that can help you understand the price bias for the day. You also know that bounces off the range to the upside are signs of strength whereas bounces off the range to the downside are signs of weakness. When price gets near the pivot range, the most helpful price action is a candle wick bouncing off the range showing that price was rejected near that level giving you a further confirmation to enter in the direction of the current move.

LEARN FOREX: Candle Wicks Near The Range Help Confirm Entries

Closing Thoughts

The importance of the pivots and the pivot range concept is because the majority of traders in the market are focusing on those key levels and thanks to recent memory of the recent price action, this can lead to a valuable self-fulfilling prophesy. When trading the pivot range, you can place your stop opposite the range of the direction you’re trading. This means that if you’re selling a currency pair, the stop can be on the top side of the range or if you’re buying, a stop can be placed on the bottom side of range.

Happy Trading!

--Written by Tyler Yell, Trading Instructor

To be added to Tyler’s e-mail distribution list, please click here .

Become a Smarter Trader Today

Claim your FREE universal membership to Internet Courses & save yourself hours in figuring out what FOREX trading is all about.

You'll get this FREE 20 minute “New to FX” course presented by Education . In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

You can instantly register for free here to start your FOREX learning now!

Here’s another great resource if you’re new to FX? Watch this video