Article Summary: Breakouts occur when areas of support or resistance collapse. Today we will review trading tips for trendline breakouts.

Drawing a trendline can be an extremely useful technical tool for Forex traders. While traders initially will use a validated trendline to trade market swings with the primary trend, they can also be used for breakouts. So what exactly should a trader do in the event that price moves through an existing line of support or resistance? Today we will find out as we examine what to do in an instance where price breaks through an existing trendline.

(Created using FXCM’s Marketscope 2.0 charts)

Trading a Breakout

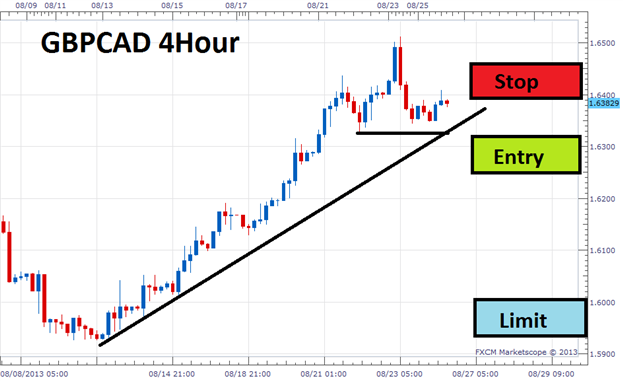

First, before a breakout strategy can be traded, traders need to establish a clear line of either support or resistance. Above we can see the GBPCAD on a 4hour chart with a validated trendline supporting its upward move. While there have been many opportunities to buy into the current uptrend, breakout traders will wait patiently for this line of support to collapse. In the event that price moves through these level, traders can reasonably assume the primary trend has ended and reconfigure their trading bias.

Breakout traders will look to take advantage of the first price swing a currency pair makes. In the instance of the GBPCAD uptrend, traders will set entries under the rising trendline. In the event price breaks our trendline orders will be triggered as traders attempt to then trade towards lower lows. Pictured below we can see this plan put into action with a potential entry to sell the GBPCAD on a breakout below 1.6319.Now all that is needed is a stop and limit to complete this trading plan.

Learn Forex – USDCHF 4Hour with ATR

(Created using FXCM’s Marketscope 2.0 charts)

Stops and Limits

To complete the trade idea, traders can look to limit their risk using a stop above the previous line of support. Traders can set their stop 1 ATR value above this line, so in the event of afalse breakout, traders will wish to exit any newly created short positions. Profit targets can be managed in a variety of ways as well. Traders may extrapolate their risk to find a positive Risk:Reward ratio or even employ a trailing stop to lock in profit as a new trend develops.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.

New to the FX market ? Learn to trade like a professional with !

Signup for this free “ Trade Like a Professional ” certificate course to help you get up to speed on Forex market basics. You can master the material all while earning your completion certificate.

Register HERE to start your Forex learning now!