Talking Points

- Don’t overlook risk management in your trading plan!

- Always use a positive Risk/Reward ratio.

- Never risk more that 1% of your account balance on any give trade.

While most traders identify planning an entry as the most important step in their trading strategy , it is important to add as much if not more emphasis on risk management. Successful traders always consider managing risk and before we ever place a trade we should consider the outcome of our order.

To help us better prepare for the upcoming trading year, today we will look at risk management with a focus on risk reward ratios and the 1% rule.

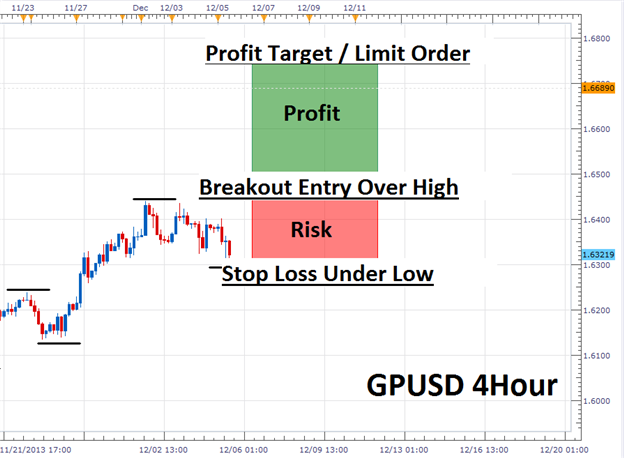

Learn Forex – GBPUSD with Risk/Reward

Risk Reward Ratios

When it comes to risk, it is actually just important to consider how much we are risking relative to how much potential profit we stand to make. This is what traders refer to as a Risk/Reward ratio . Understanding these ratios can help traders avoid trading’s number one mistake, which is risking more relative to a trades potential gains.

So what does this mean for traders? When measuring your stop loss in pips, you should also use this as a reference when setting your profit targets. Looking at the chart above we see a stop placed on a GBPUSD breakout of 150 pips. This means to setup a 1 to 2 Risk/Reward ratio our limit should be at minimum 300 pips away. While these ratios can be changed for personal preferences, using a 1 to 2 Risk/Reward ratio on every trade means that you only need to be correct 1 out of every 3 trades (33% accurate) to be break even, if not net profitable on your trading account.

Learn Forex – Gold & Dollar Correlation

The 1% Rule

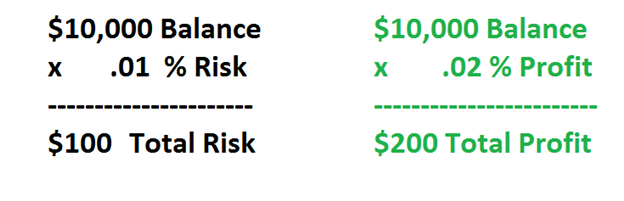

While no one wants to experience a loss on their account, it is always important to have a plan of action to limit their drawdown. As well as using a stop, traders should also consider the 1% rule. This means that traders should never risk more than 1% of their account balance on any one trading idea. That means using the math above, if you are trading a $10,000 account you should never risk more than $100 on any one positions.

The 1% rule can also be coupled with a favorable risk reward ratio. Using a 1:2 setting, this means if we risk 1% in the event of a loss, at minimum we should look to close our trades out for a 2% profit. This would translate into a $200 profit on a $10,000 account balance.

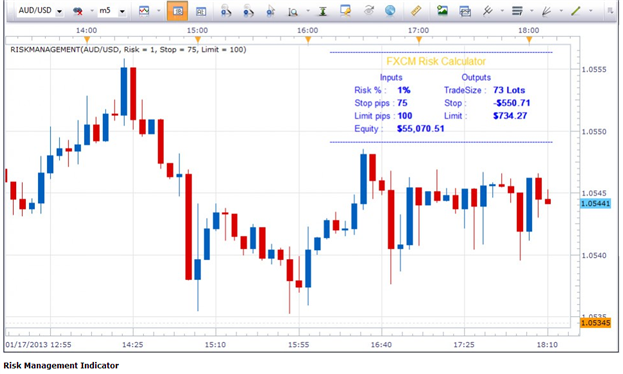

To help traders control their risk, programmers at FXCM have created a simple indicator to help decipher how much risk is being assumed on any one particular trade. Once added to Marketscope 2.0, the FXCM Risk Calculator has the ability to help a trader calculate risk based off of trade size and stop levels. This tool is great and to help hold our selves accountable to a predefined strategy that includes proper risk management. To learn more about the FXCM Risk Calculated visit the FXCM App Store .

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.

Become a Smarter Trader Today

Claim your FREE universal membership to Internet Courses & save yourself hours in figuring out what FOREX trading is all about.

You'll get this FREE 20 minute “New to FX” course presented by Education . In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

You can instantly register for free here to start your FOREX learning now!