Talking Points:

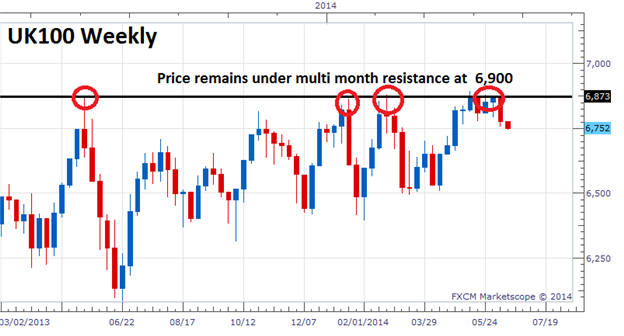

- The Uk100 has failed to break over 6,900

- Price is still trading above support

- A lower low must be made for the trend to turn

Stock markets around the world have been making record runs over the past few years. However, with prices taking a pause, many traders are left to wonder if or when their favorite equities indices will turn. While fundamentally this can become a challenge, technical traders can use a series of price action clues to help them identify if indeed the market has turned. Today we will review the UK100 and identify tips to help better time the market. Let’s get started!

Learn Forex –UK100 Resistance Points

(Created using FXCM’s Marketscope 2.0 charts)

Support & Resistance

The first clues that a trend has turned revolve around finding levels of support and resistance. In the event of an uptrend prices must be making higher highs, which in turn suggest rising points of resistance. The chart above displays a weekly graph of the UK100 ( FTSE ). Even though prices have generally been rising, prices have stalled under 6,900. While the lack of a new high doesn’t suggest that the market has turned, in the absence of a new breakout the trend should be at least in the interim considered stalled.

Now to get the full story of price action, technical traders should also identify key areas of support. In order for an uptrend to be concluded price must be seen breaking down towards a series of lower lows. These areas can be identified by pinpointing areas of price support. Below we can again see the UK100, but this time we have added an advancing line of support as a series of higher lows have been printed on the chart. In the absence of a breakout or any lower lows, traders can continue to say that the prevailing trend has not changed.

Learn Forex – EURUSD Trading Blocks

(Created using FXCM’s Marketscope 2.0 charts)

Trad ing a Turn

Even in the absence of new highs or lows traders can begin looking for new trading opportunities. In these scenarios traders should consider trading a breakout . This will allow traders the opportunity to have entry orders pending in the event that price does turn and moves towards a fresh low. Entry orders can also be helpful in the event that a trend continues. If your order is set to sell the market pending a reversal under a point of support and price breaks resistance to a higher high, the order can simply be deleted. Traders will then be free to look for other opportunities.

Identifying key technical levels takes practice. You can get started analyzing the UK100 along with your favorite currency pairs such as the EURUSD with a Free Forex Demo with FXCM. This way you can develop your trading skills while tracking the market in real time!

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.

New to the FX market ? Save hours in figuring out what FOREX trading is all about.

Take this free 20 minute “New to FX” course presented by Education. In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

Register HERE to start your FOREX learning now!