Talking Points

- GBPUSD Stays Range Bound

- R3 Resistance Sits at .1.6589

- Market Breakout Signaled Over 1.6599

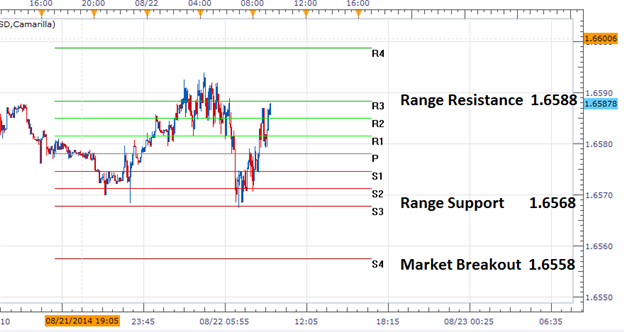

GBPUSD 30min Chart

(Created using FXCM’s Marketscope 2.0 charts)

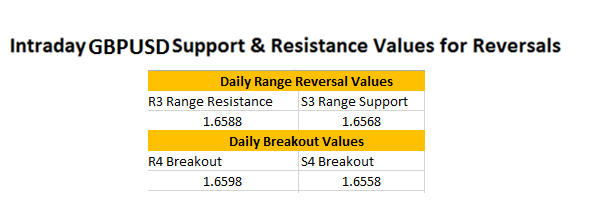

The GBPUSD has continued to move in a defined trading range overnight and into the first minutes of the U.S trading session. Price first moved to S3 support at 1.6568, before moving back to resistance levels. Range resistance is currently found at 1.6588, near the R3 camarilla pivot. Again after the first test of resistance price remained range bound moving back to identified support. At present, price is again attempting to clear the pairs 20 pip range. After three daily moves between range support and resistance, range reversal traders will look for these values to hold unless market conditions change.

Traders should always be mindful of the potential for a market breakout . A move above the R4 camarilla pivot would indicate the market is attempting to break to a higher high, counter to the current daily trend. Conversely a break below S4 support at 1.6558 would signal a strong continuation, as the GBPUSD would be heading back to new lower lows. In either scenario, a breakout would signal an end to ranging conditions and traders should react appropriately.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.

Previous Market Setups:

FX Reversals: USDJPY Morning Breakout

FX Reversals GBPJPY Begins Week at Highs

FX Reversals: EURCAD Moves to Range Support