Talking Points

- NZDUSD is Current Range Bound

- R3 Support Sits at .8295

- Market Breakouts Signaled Under .8274

NZDUSD 30min Chart

(Created using FXCM’s Marketscope 2.0 charts)

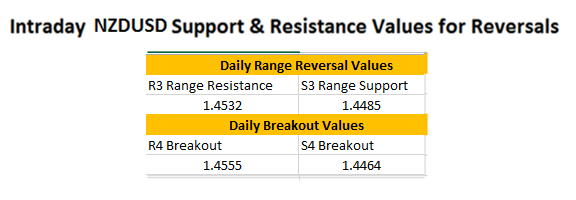

The NZDUSD starts the week supported going into the US session open. Currently price resides at range support, near the S3 camarilla pivot found at .8295. In the event price remains supported for the session, traders can look for a potential price bounce back towards range resistance. Currently resistance sits near the R3 pivot point at .8338, completing the days 43 pip trading range.

A breakout below the S4 pivot would signal a strong reversal back in the direction of the NZDUSD’s current daily trend. It should be noted that price has declined as much as 566 pip over the last two months of trading. Conversely a price break above R4 resistance at .8360, would indicate momentum shifting towards a higher high. In either of the above breakout scenarios, the range should be considered invalidated for the day with traders then positioning themselves with the markets new direction.

Are you unfamiliar with camarilla pivots and trading intraday market reversals? Feel free to catch up, on the latest information using the article series linked below!

FX Reversals with CCI and Cam Pivots

Trading Intraday Market Reversals

Then, to practice setting up orders using Camarilla Pivots, register for a FREE Forex demo with FXCM . This way you can develop your scalping techniques while tracking the market in real time.

Click HERE to Register Now

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.

Previous Market Setups:

FX Reversals: EURGBP Breaks Final Support

FX Reversals: EURUSD Morning Reversal Update