Talking Points

- USDollar Opens in a Range

- R3 Resistance Sits at 10,858

- Market Breakouts Signaled Above 10,873

GBPUSD 30min Chart

(Created using FXCM’s Marketscope 2.0 charts)

Suggested Reading: Trading Intraday Market Reversals

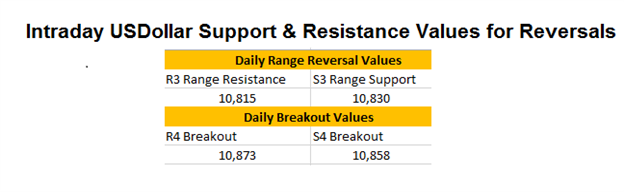

Despite its strong gains so far throughout the trading week, The Dow Jones FXCM Dollar Index (USDollar) has stalled today inside of a trading range. As seen above, price has already traversed the daily trading range multiple times, and is still trading between support and resistance . Currently price is trading near its central pivot at 10,844. Range traders will wait for price to either meet resistance at the R3 pivot at a 10,858 or test support at S3 pivot before planning any additional entries.

Even though price is currently range bound, conditions can change quickly for the USDollar. A price breakout above R4 pivot resistance at 10,858 would signal a strong continuation back in the direction of the USDollar’s daily trend. Month to date, the Index has moved as much as 235 points higher. Knowing this, breakout traders will look to pick entries as key lines of resistance collapse. Conversely a price move below the S4 line of support would increase the potential for a counter trend reversal, on the creation of a lower low. In either breakout scenario, ranging markets will be considered concluded with traders looking to take orders with the newly created daily momentum.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.

Previous Market Setups:

FX Reversals: USDCHF Trading Values

FX Reversals: USDCAD Post News Update