Talking Points

- AUDUSD Opens in a 62 Pip Range

- Range Resistance is Found at .8847

- Breakouts Signaled Under .8723

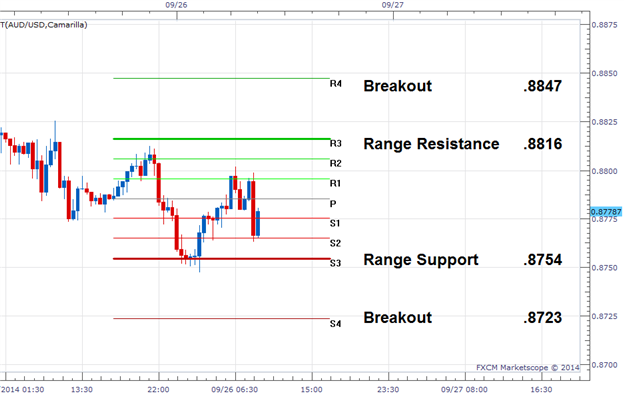

AUDUSD 30min Chart

(Created using FXCM’s Marketscope 2.0 charts)

Suggested Reading: Trading Intraday Market Reversals

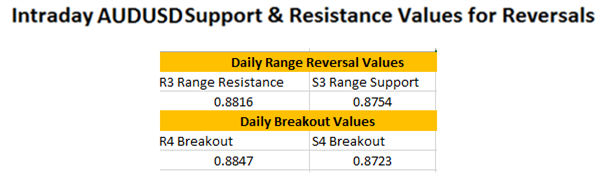

After dropping as much as 112 pips during yesterday’s trading, many traders are looking for another big day for the AUDUSD. However, so far price has remained range bound for the pair going into the U.S. session open. So far price has tested, but not broken, both values of support and resistance for today’s 62 pip trading range. Currently range resistance is found at the R3 camarilla pivot, at a price of .8816. Range support is found at the S3 pivot, found at a price of .8754. If volatility slows, as the final close of the trading week approaches, traders can continue to look for range bound trading opportunities.

In the event that prices do not hold the range, traders can begin looking for a continuation of the daily trend below the S4 pivot at a price of .8723. This would signal a new lower low, along with fresh downward momentum providing new trading opportunities for breakout and trend traders alike. In this scenario, day traders can look to conclude any range based positions and adjust to the markets current directional bias.

Yesterdays Update

Yesterday, traders were looking for yet another decline of JPY pairs. The EURJPY was trading near S4 line of support and had broken to a lower low by the close of U.S. session trading. Since this point, the pair has opened a new set of pivots with trend traders looking at values of resistance to trade retracements back towards lower lows. To learn more about yesterday’s action, check out Wednesday’s FX Reversal article linked below.

FX Reversals: EURJPY Breakout Update

Then, to practice setting up orders using Camarilla Pivots, register for a FREE Forex demo with FXCM. This way you can develop your day trading techniques while tracking the market in real time.

Click HERE to Register Now

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.