Talking Points

-Bank of Canada surprises with a 25 basis point cut due to drop in Oil

- USD/CAD rockets higher on the news

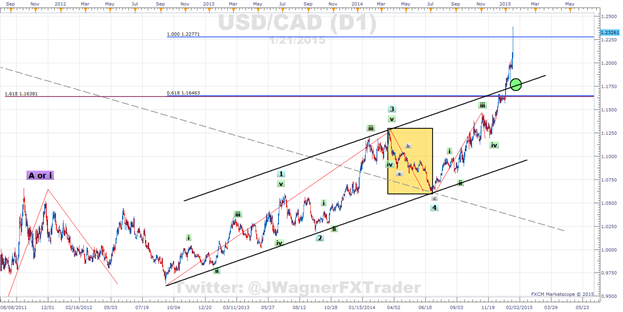

-Potential extended 5 th wave of the Elliott Wave sequence

To receive future articles via email on trading ideas using equal waves, Elliott waves, and triangle patterns, click HERE and enter your email information.

The USDCAD has gained nearly 450 pips in the last two days. Prices accelerated higher after the Bank of Canada surprised the market with a 25 basis point cut. Oddly enough, 7 years ago tomorrow (January 22, 2008), the Bank of Canada and the Federal Reserve released emergency rate cuts to the market to keep deflation at bay. Here we are 7 years later and fighting the forces of deflation in Europe which is trying to sneak onto North American soil.

Though the larger degree Elliott Wave count going back to 2007 could be debated, the recent price action suggests we are in an extended wave 5. There is a wave relationship that comes into play near 1.2550. The reaction, if any, at the 1.2550 price level will provide additional clues about the importance of that wave measurement.

USD/CAD Daily

Since Canada relies on oil , a strong move in oil can also drive the USDCAD.

Other Recent Elliott Wave Counts:

Oil Finishes Wave 3 Down (5 minute video)

Gold and a Bullish Elliott Wave Count (5 minute video)

Elliott Wave Analysis for EUR/GBP (6 minute video)

AUD/USD Carves an Equal Wave Pattern (6 minute video)

Not sure what an equal wave pattern is? Watch this 10 minute video.

Additional t ools to identify levels and sentiment on USDCAD:

Instant Support and Resistance Levels, a Simple Must_have Tool (article)

The Plus Technical Analyzer (free registration required)

Speculative Sentiment Index (free registration required and provides access to the Technical Analyzer too)

-Written by Jeremy Wagner, Head Trading Instructor, EDU

Follow me on Twitter at @JWagnerFXTrader .

See Jeremy’s recent articles at his Forex Educators Bio Page .

This article uses Fibonacci ratios to follow a variety of patterns including Elliott Wave. To learn more about Fibonacci ratios, register to take this free 20 minute on demand course. Register here .