Talking Points:

-Market conditions improving for breakout strategies

- GBPJPY SSI becomes more extreme to +3.2

-SSI perks up on many USD pairs

The Plus Breakout2 strategy is one of the more widely followed by traders. This piece aims to identify those markets where breakout conditions are prevalent, and thus a follow through of the breakout is more likely.

Volatility began to perk up a week ago as four central bank rate announcements plus the United States jobs report were released. This week was going to provide a better sense if volatility and breakouts would have a better chance of follow through. Market conditions for the Breakout2 strategy is improving, though still not ideal.

The Sterling has been the darling for the past couple of weeks, which we have been highlighting in previous writings.

The SSI readings have flipped to extreme readings in both the GBPJPY and GBPUSD for the past few weeks as traders attempt to pick bottoms on the GBP . Thus far, the SSI signal has worked as the GBP continues its strong sell off.

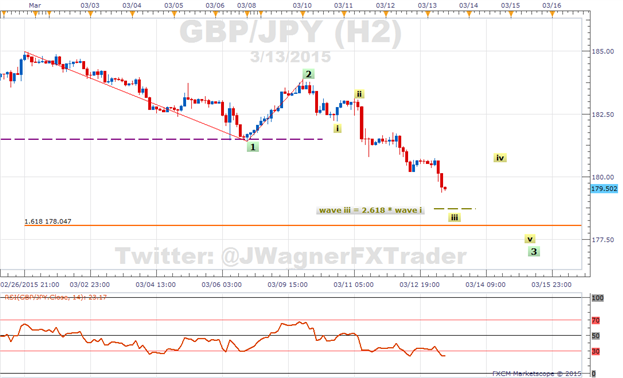

GBP/JPY 2 Hour Chart

( Created using FXCM’s Marketscope charts)

For example, the GBPJPY SSI reading has been above +2.0 for 5 weeks now. During that time, the trend in the GBPJPY has strongly planted to the downside. According to Elliott Wave analysis (above), it appears this downtrend still has more gas left in the tank as we are in the midst of green wave 3.

Once five green waves are finished to the downside, then we can reassess the bearish outlook. Until then, the SSI, volatility, and trend appear aligned with the rules of the Breakout2 strategy. As a result, the GBPJPY was upgraded to the maximum conviction rating of ‘3’.

We wrote about the GBPUSD last week as aligning more closely with Breakout2 strategy rules. Its trend, SSI, and volatility are aligned even deeper with the strategy rules so it is upgraded to a conviction ‘3’ as well.

Lastly, the USD appears to be gaining solely against the GBP for the past couple of days. This is an interesting development and when coupled with SSI showing more USD buyers, could be a symptom of a potential USD turn coming towards weakness. As a result, we’ve upgraded the NZDUSD to a ‘2’ rating as the commodity currencies are holding firm against the dollar. Perhaps the NZD could be a leader if indeed the USD turns towards weakness.

Plus Breakout2 Conviction Chart for March 13, 2015

| ADX | ROC | Volatility Expansion? | Sentiment Signal | Conviction | |

|---|---|---|---|---|---|

| EURUSD | Trend | Bearish | Yes | Bullish | 1 |

| AUDUSD | Range | Bearish | Yes | Bullish | 1 |

| GBPUSD | Trend | Bearish | Yes | Bearish | 3 |

| NZDUSD | Trend | Bearish | Yes | Bullish | 2 |

| USDCHF | Trend | Bullish | Yes | Bearish | 1 |

| USDCAD | Trend | Bullish | Yes | Neutral | 1 |

| USDJPY | Range | Bullish | No | Bearish | 1 |

| EURJPY | Trend | Bearish | No | Neutral | 1 |

| GBPJPY | Trend | Bearish | Yes | Bearish | 3 |

| CHFJPY | Trend | Bearish | No | Bullish | 1 |

| AUDJPY | Range | Neutral | No | Neutral | 1 |

| EURAUD | Trend | Bearish | No | Neutral | 1 |

To receive future articles emailed to you regarding the conviction ratings for the Plus Breakout2 signals or trading an automated portfolio, sign up for the distribu t ion list here.

Last Week’s Conviction Report: GBPUSD Sentiment Becomes Extreme

Bold and italicized ratings above represents a change in the rating from last week. There were three changes last week (GBPJPY, GBPUSD, NZDUSD).

As you can see in the chart above, the ADX and Rate of Change (ROC) are grouped together. Since the ADX doesn’t indicate direction, only strength of move, we want to couple it with a rate of change indicator.

When trading a breakout strategy, ideally we would like to see prices in a trend and moving. This would increase the chance of a breakout that would follow through. If prices are in a range and if the ROC is neutral, that indicates there isn’t prices are comfortable near the current levels until a catalyst creates discomfort for the price.

Ideally, we would like to see a directional move take place with expanding volatility. Expanding volatility can be measured through analysis of ATR range or perhaps volume expansion.

The fourth item is sentiment as read through FXCM’s SSI. The result of the “Bearish” means the SSI reading is > 1.22 and “Bullish” means SSI is <-1.22. For a current reading of SSI, log into Plus ( sign up for a free trial if you don’t have a live FXCM account) and view the Speculative Sentiment Index section (SSI).

When taking this together and a conviction reading is assigned. It is important to understand the conviction reading is the opinion of the author and not a recommendation to trade, use, or not use the Plus Breakout2 strategy.

A conviction rating of ‘3’ means the ingredients exist for a breakout market condition that the Breakout2 strategy enjoys. A reading of ‘1’ represents a mixed bag and that the Breakout2 strategy is more at risk of a market condition that doesn’t cater as well to breakouts.

For example, the GBPUSD was given a ‘3 ’ conviction due to an extreme SSI reading of +2.0 .

Therefore, the conditions exist for a potential follow through of a breakout in the GBPUSD, if a breakout trade sets up.

---Written by Jeremy Wagner, Head Trading Instructor, Education

The Plus Breakout2 strategy can be automated. If you wish for the trades to trigger automatically into your account, register for a Mirror account which provides you access to dozens of other strategies as well.

Follow me on Twitter at @JWagnerFXTrader.

See Jeremy’s recent articles at his Forex Educators Bio Page.

Feedback? Email Jeremy at [email protected]