Talking Points

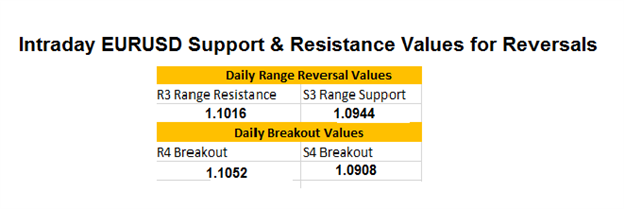

- The EURUSD attempts to breakout over 1.1052

- Breakouts are invalidated below 1.1016

- A break below 1.0908 would signal a broader bearish reversal

EURUSD 30Minute Chart

(Created using FXCM’s Marketscope 2.0 charts)

Looking for more FX Reversals? S ign up for my email list here: SIGN UP HERE

The EURUSD is again attempting to breakout to new highs after this morning’s GDP release. GDP came in at 0.2% relative to a forecasted 1.0%. Prices immediately tested the R4 Camarilla pivot at 1.1052, but failed to close above this value on a 30minute chart. Even after a retracement and the creation of a long wick, price is again attempting to move back through the R4 pivot. In the event of a price breakout, traders can then use today’s 108 pip trading range to extrapolate potential price targets.

If price moves back inside of today’s trading range, starting with the R3 pivot point at 1.1016, it would signal the possibility of a false breakout from today’s GDP event. This alternative would open the possibility of the EURUSD dropping back towards values of support including the S3 Camarilla pivot found at 1.0944. A continued decline below the S4 pivot at 1.0908 would suggest a broader reversal for the pair leading to the creation of a new lower low.

Using Camarilla pivots is just one way to approach day trading. To help you get started in your trading pursuit, hosts a variety of day trading webinars. To learn more and register for future events, see the webinar calendar listed HERE .

---Written by Walker England, Trading Instructor

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

To contact Walker, email [email protected] .

Contact and Follow Walker on Twitter @WEnglandFX.

Video Lessons || Free Forex Training

Trading Using Fibonacci (13:08)

Reading the RSI, Relative Strength Index (13:57)