Talking Points

- The EUR/USD trades higher before FOMC

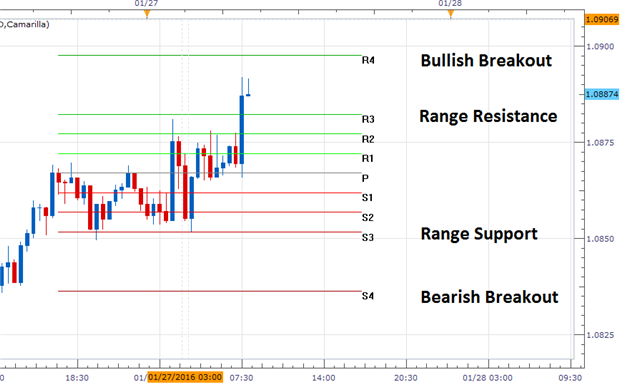

- Bullish breakouts begin over 1.0913

- Bullish reversals begin under 1.0882

(Created using Marketscope 2.0 Charts)

What is in store for the US Dollar in 2016? See our Analyst forecast here!

The EUR/USD is trading up .2% this morning, ahead of today’s highly anticipated FOMC rate decision . While the FED is expected to hold key interest rates at .50%, this event is also expected to produce volatility in major US Dollar pairs. As of this morning, the EUR/USD has already bounced from support found at 1.0851. With price, action now approaching the R4 resistance pivot at 1.0897. Traders looking for an extended rally in the EUR/USD can use a 1-X extension of today’s 31-pip range to find targets near 1.0913.

In the event that prices begin to range prior to the FOMC rate decision , traders will look for the EUR/USD to trade back inside of range resistance found at the R3 pivot at a price of 1.0882. A move to this point of the graph opens up price action to again test range support, which is found at today’s S3 pivot at a price of 1.0851.

Traders tracking sentiment should note that SSI ( Speculative Sentiment Index ) for the EUR/USD is currently reading at -1.37. This value is slightly negative with 58% of positioning short the EUR/USD. While this value is not extreme, if prices begin to breakout during the FOMC rate decision traders can track SSI to validate any emerging market trends.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guide to find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.