Talking Points

- The EUR/USD Trades Flat After Rate Decision

- Markets Look to Mario Draghi for Guidance

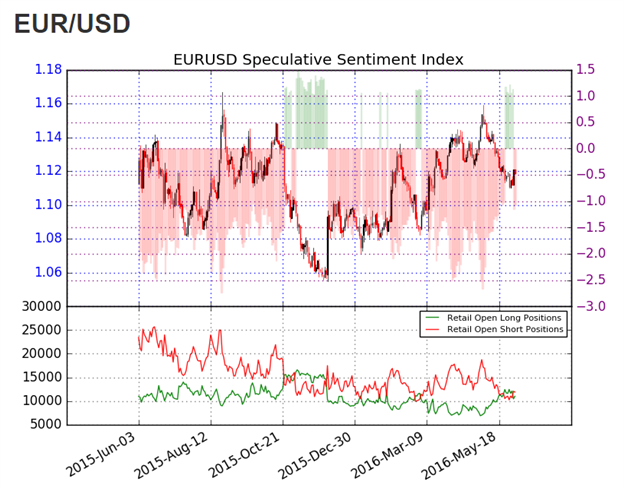

- SSI Remains For the EUR / USD Reads Flat at -1.08

Looking for additional trade ideas for the EUR/USD? Check out our Trading Guide

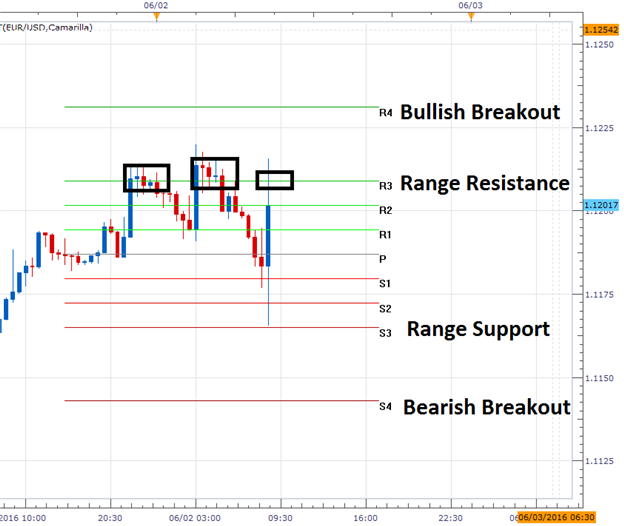

EUR/USD 30 Minute Chart

(Created using Marketscope 2.0 Charts)

The EUR/USD continues to range this morning, after the ECB released their decision for key interest rates. As expected, the ECB held rates flat at 0.00%. Now the market is looking towards today’s speech from Mario Draghi, to gain further insight into ECB policy. While this morning’s event did not cause much volatility in the markets, Draghi’s commentary could be the catalyst that causes the Euro to breakout later in today’s session.

Today’s pivot range begins at the R3 pivot marking resistance at a price of 1.2079. Price action has tested this point 3 times, but so far has failed to breakout higher. In the event that prices stay beneath this value, it opens the EUR/USD to move back towards values of support. The S3 pivot point marks the bottom of today’s 44-pip range, which is found at 1.11639.

It should be noted that bullish breakouts for the session might begin above 1.1230. In this scenario, traders may look for a 1X extension in price to place initial bullish targets near 1.1274. Alternatively, if the EUR/USD breaks lower, traders may look for a move below 1.11418. A move under the R4 pivot would allow traders to again extrapolate 1X today’s range to place bearish breakout targets starting at 1.10978.

Why and how do we use SSI in trading? View our video and download the free indicator here

Sentiment for the EUR/USD has remained flat this morning, with SSI ( speculative sentiment index ) reading at -1.08. With positioning virtually split between long and short positioning, this may signal a continuation of current market conditions. If price action breaks out later today, traders may validated the move with a turn in SSI towards either a positive or a negative extreme.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guide to find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.