Talking Points

- The USD/CAD Opens Lower, Declining 68 Pips

- Short Term USD / CAD Support is Found at 1.2930

- If you are looking for Forex trading Ideas, check out our Trading Guides .

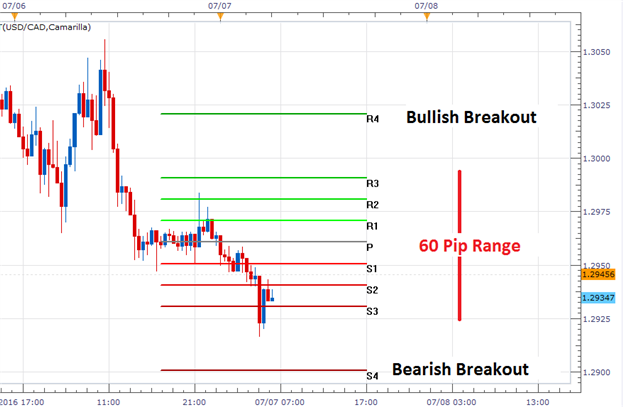

The USD/CAD is selling off for the second consecutive trading session, and has declined as much as 68 pips on the day. Currently the pair has found support near 1.2930. This area of support is seen in the graph below at today’s S3 Camarilla pivot. If price remains above this value, it opens the USD/CAD to trade back towards values of resistance. This includes range resistance which is found at the R3 pivot at a price of 1.2990.

In the event that the USD/CAD declines below the S3 pivot, traders may again look for bearish breakouts below the S4 pivot at 1.2908. A move below this value could be seen as a continuation of yesterday’s decline, and open the pair to trade back toward weekly lows. In the event of a bearish breakout, traders may extrapolate a 1X extension of today’s 60 pip trading range to place initial targets near 1.2848.

USD/CAD 30 Minute

(Created by Walker England)

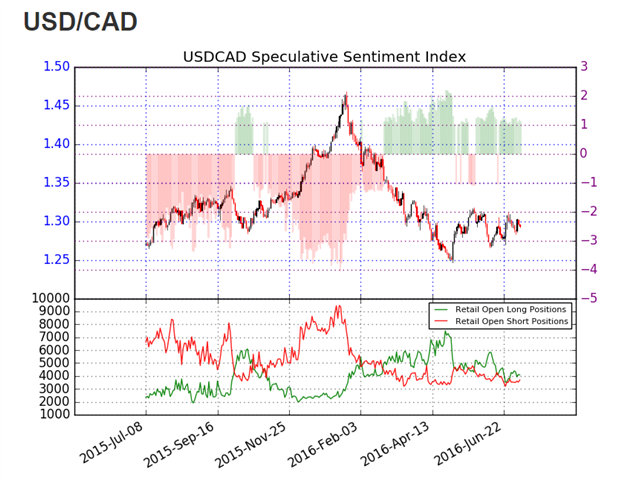

The ratio of long to short positions for the USD/CAD stands at +1.11. This SSI (speculative sentiment index) reading is relatively flat, but does have a slight bias towards further USD/CAD price declines. In the event that the pair trades lower, traders should look for SSI to move towards a positive extreme of +2.0 or more. Alternatively in the event of bullish reversal, traders should look for SSI to neutralize and potentially flip to a negative reading.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.