Talking Points

- Silver Prices Swing Lower on NFP Data

- Bearish Reversals for Silver Begin Under $19.20

- If you are looking for more trading ideas for commodity markets, check out our Trading Guides

Silver prices declined early Friday morning, in reaction to a surging US Dollar . This move was predicated on the US Dollar rallying on better than expected NFP numbers. After its initial move lower, Silver prices have rebounded after printing a new weekly low at $19.20. However, despite this bounce in price, silver has yet to retest the weekly high at $21.11. Going into next week’s trading, traders should continue to monitor these values to help determine Silvers next direction

Silver 1 Hour Chart

(Created using Marketscope 2.0 Charts)

In the event that Silver prices decline next week, a breakout below $19.20 should be considered significant. A move through this point of support would expose the next key value of support at $17.99. This area is represented by the May 2016 high, and a move under this value would suggest that the daily bull trend for Silver has at least temporarily suspended and open the metal up to further declines.

Alternatively, if Silver continues to rally from current levels, traders should look for next resistance near $20.48. A move through this point would suggest that today’s decline is nothing more than a retracement. In which point, traders may look for silver to trade back up to monthly highs at $21.11.

Find out real time sentiment data with the ’s sentiment page .

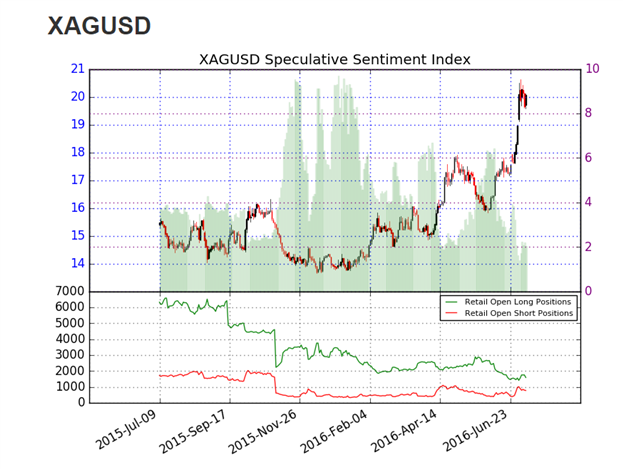

Sentiment for Silver (Ticker: XAG/ USD ) remains extreme with SSI ( speculative sentiment index ) reading at +2.06. With 67% of positioning long, SSI suggests that the metal may be setting up for further declines. Alternatively, if Silver breaks higher next week, traders may look for SSI to decline away from its current extremes.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guide to find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.