Talking Points

- Crude Oil Prices Consolidate After Reaching Monthly Highs

- Intraday Crude Oil Prices Decline Towards Support

- Looking for additional trade ideas for Crude Oil and other commodities? Check out our Crude Oil Trading Guide

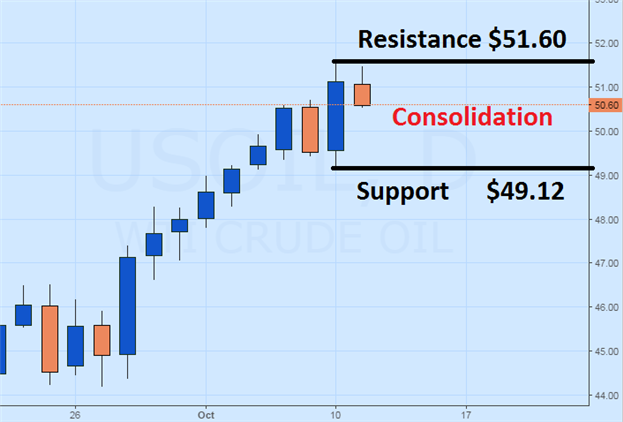

Crude Oil prices have traded to new monthly highs, by printing a peak price of $51.60 in Monday’s trading. Despite this significant advance in prices, Crude Oil is now stalled, failing to breakout to new highs or lows in today’s session. Technically traders looking for Crude Oil’s next breakout may reference Monday’s daily bar for support and resistance. A breakout above the high of $51.60 may be interpreted as continuation of the ongoing bull trend in Crude Oil. Alternatively, a breakout below Monday’s low of $49.12 may signal the beginning of a bearish retracement for the commodity.

Crude Oil Prices 1 Day, Consolidation

(Created using TradingView Charts)

As prices consolidate, traders may look to short term momentum cues to decipher the current market conditions for Crude Oil. Referencing the 10-minute graph below, the price of Crude Oil can be seen trending lower off of the daily highs at $51.40. The Grid Sight Index (GSI) has picked up this move as a short term downtrend, by identifying a series of lower lows created in the last 3 hours of trading. After reviewing 3,665,995 pricing points, GSI has also indicated that price action has continued to decline by $0.22 or more in 59% of the reported 37 matching historical events. If prices continue lower, traders may look for Crude Oil to test other points of support as the commodity moves on yesterday’s daily low of $49.12

Alternatively, GSI has indicated that prices have advanced by $0.48 or more in 56% of the identified historical instances. This places the first bullish historical distribution at a price of $51.01. A move through this point would signal a shift in short term momentum, but not an end of today’s consolidation. In this scenario, traders may look for prices to again approach daily highs, and attempt bullish breakouts above $51.60.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.