Talking Points

- Gold Prices Open the Week in a Holding Pattern

- Daily Support for Gold Prices Found Above $1,241.27

- Looking for additional trade ideas for Gold and other Commodities ? Check out our Gold Trading Guide

Gold prices remain in a holding pattern, with the open of Mondays trading marking the 6th session of consolidation for the commodity. Key daily resistance for the price of Gold remains above $1,265.34, while support is found near $1,241.27. Traders will be looking for Gold prices to breakout this week with the release of several high importance news events. This includes US CPI data released on Tuesday with an expectations set at 1.5% (YoY) (Sep), and Australian Employment Change data released on Wednesday with expectations of +15.0K (Sep).

Gold Price 1 Day, Support & Resistance

(Created using TradingView Charts)

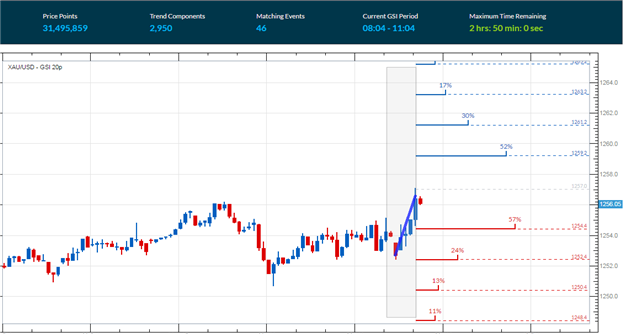

In the short term, Gold prices may be seen rising off of the daily lows at $1,250.09. Referencing the 10 minute graph below, the Grid Sight Index (GSI ) has identified this morning’s move as a short term uptrend as prices continue to bounce from support. After reviewing 31,495,859 pricing points, GSI has also indicated that price action has continued to advance by $2.20 in 52% of the reported 67 matching historical events. With a little over half of the historical matches showing an increase in price, today’s first bullish price distribution is found at $1,259.20. If prices move through this value, it may open the commodity up to test the daily value of resistance previously mentioned at $1,265.34.

Alternatively, GSI has indicated that prices have declined by $2.60 or more in 57% of the identified historical instances. With both bearish and bullish historical values reading near similar values, this is typically indicative of a consolidating market. Traders should note however, that today’s first bearish distribution is found at a price of $1,254.40. If Gold prices drop below this point, it may open the commodity up to challenge the current daily low as well as longer term support at $1,241.27.

---Written by Walker England, Market Analyst

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.