Talking Points:

- Gold Prices React to a Stronger US Dollar

- Intraday Support For Gold is Found at $1,128.28

- Looking for additional trade ideas for Gold and commodities? Read Our Market Forecast Here

Gold prices are getting no relief in early trading today, as the market processes yesterday’s FOMC rate decision . While the event produced a 0.25% rate hike as expected, forward guidance is now leaning towards 3 potential rate hikes for the 2017 trading year. This policy move has caused the US Dollar to make significant gains and send commodity prices as a whole lower.

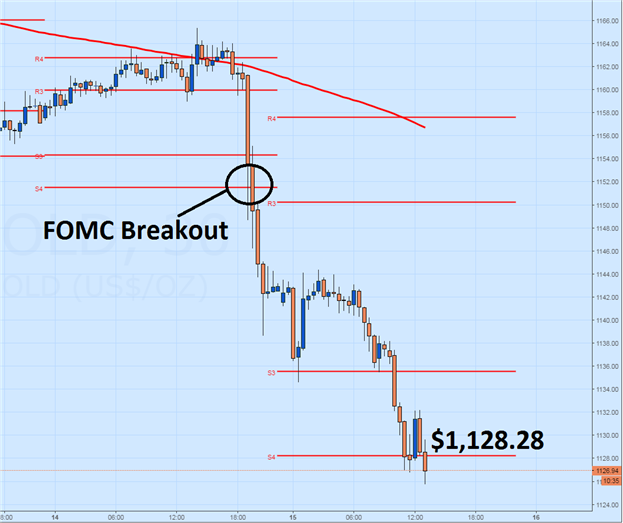

Technically, Gold prices are continuing to decline through every short term point of support intraday. Temporary support was found at today’s S3 pivot at 1,135.70, but that value was short lived as the downtrend has intensified. Now Gold is trading at the last point of intraday support at 1,128.28. This point is depicted below as the S4 pivot, and a move beneath this point exposes longer term values of support which includes the February 2016 low of 1,115.58. In the event that prices rebound, key points of intraday resistance includes the R3 pivot found at $1,150.26.

Gold Price 30 Minute Chart & Pivots

(Created Using TradingView Charts)

Intraday analysis of the US Dollar (Ticker: DXY) has the Index at intraday resistance at 103.10. Traders should note that today’s high of 103.22 now stands as the highest reading seen December of 2002. If prices breakthrough today’s R4 pivot, traders may begin targeting the next point of long term resistance found at 107.31. In the event of a price reversal, traders may look for the US Dollar to decline back through the R3 pivot which is found at 102.66.

US Dollar 30 Minute Chart & Pivots

(Created Using TradingView Charts)

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.