Talking Points:

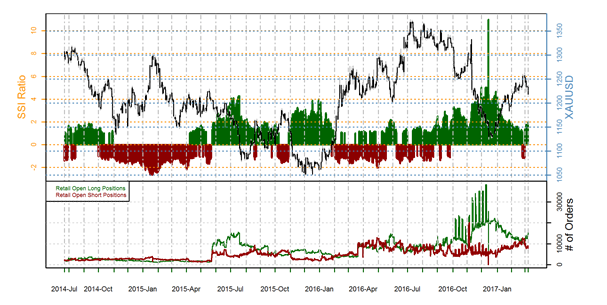

- Sentiment For Gold Price Reaches Extremes Ahead of NFP

- SSI Reads at +2.00 with 67% of Traders Long

- Looking for additional trade ideas for Gold and Commodities? Read our 2017 Market Forecast

Sentiment for gold price remains at extremes going into this Friday’s highly anticipated NFP (Non-farm Payrolls) event. Currently SSI ( Speculative Sentiment Index ) figures read at +2.00, with 67% of traders long on gold prices . Typically we see these positive extremes develop when traders are buying the market, as prices trend downward. If prices continue to decline through Friday’s news, it is likely that these figures will remain at extremes. However if the market turns higher, it is reasonably expected to see SSI totals neutralize in the short term.

Technically gold prices are poised to close lower for a fifth consecutive daily session. In the short term, the metal remains below its 10 day EMA (exponential moving average) at $1,229.90. This line should continue to be monitored as a point of intraday resistance, with a breakout above this line suggesting a shift in market momentum. If prices continue to decline, the next major value of support is found at the January 27th swing low at $1,180.65.

In the event that gold prices rally on this week’s news, traders should first see the commodity breach the displayed 10 day EMA. This may be followed by an attempt to breakout above the 200 day MVA (simple moving average) found at $1254.93. It should be noted that so far gold prices have failed to breakout from this average for 2017 trading. In the event the market moves above this average, it may suggest a bullish turn in golds long term trend. At which point, traders may validate the move with a shift in SSI towards new negative extremes.

Daily Gold Price with Averages

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.