Talking Points:

- EUR/USD Prepares for a Breakout Ahead of FED News

- Current Daily Support Found at 1.0600

- Looking for additional trade ideas for the EUR / USD and the US Dollar ? Read our 2017 Market Forecast

The EUR/USD remains quiet for this morning’s trading, however volatility is expected to increase ahead of today’s FOMC rate decision . Expectations are set to see key rates to rise to 0.75%, and Janet Yellen will hold a conference shortly after this announcement to provide further information on the direction of future monetary action. As such traders should continue to monitor price action of US Dollar based pairs for potential breakout opportunities.

Technically, the EUR/USD is currently inside yesterday’s daily candle. In the absence of a higher high or lower low, traders may use Tuesday’s candle for key values of support and resistance. This includes Tuesday’s high at 1.0662 and low at 1.0600. A breakout above 1.0662 may be interpreted as bullish, and in this scenario traders may begin to target the standing March high found at 1.0714. Alternatively in the event of a bearish breakout under 1.0600, traders may look for prices to next challenge the March 9th swing low found at 1.0525.

EUR/USD Daily Chart

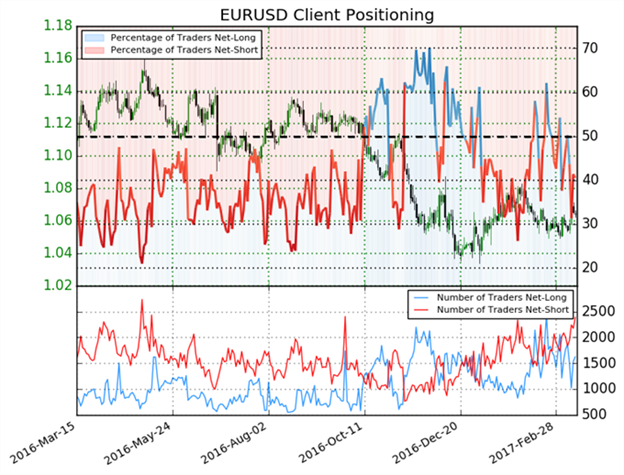

Going into this afternoon’s news, current sentiment totals for the EUR/USD remain relatively flat. IG client Sentiment for the pair is reading at -1.13, which shows that 53% of traders are currently short the EUR/USD. In the event that the EUR/USD breaks higher, it would be expected to see this value continue to move towards negative extremes of -2.0 or greater. Likewise in the event of a bearish breakout, traders may look for sentiment totals to flip positive and move towards new positive extremes for the week.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.