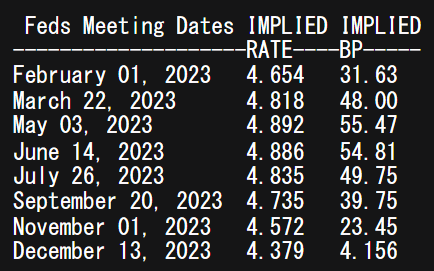

Leaving 2022 behind, gold prices have pretty much ended the year flat despite some significant price fluctuations in between. Going into Q1 of 2023, the Federal Reserve has sustained its pace of interest rate hikes as per Fed Chair Jerome Powell’s remarks and the Summary of Economic Projections in December, with notable revisions on core inflation and the Fed funds rate as shown in the table below. Although there is a substantial disconnect between the Fed’s expected 5.1% peak rate and money markets pricing at present, the hawkish nature of the December meeting may limit gold upside in Q1 – higher interest rates increase the opportunity cost of holding bullion as it is a non-interest-bearing asset.

Fed Funds Rate Probabilities

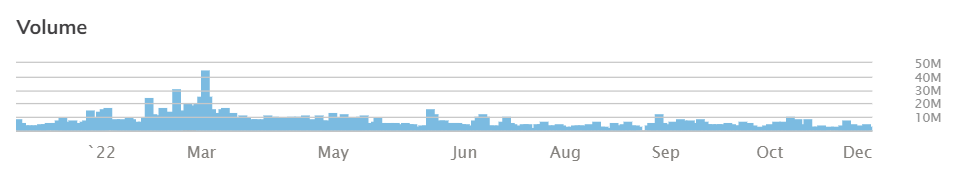

The depleted volume shown by the benchmark SPDR Gold Trust below is testament to the markets reluctance to invest in gold during periods of higher rates and with elevated rates set to continue through Q1, the outlook for gold looks bleak. Looking further into 2023, gold may turnaround should there be a concerted turn lower in rates.

SPDR Gold Trust ( GLD ) Traded Volumes for 2022

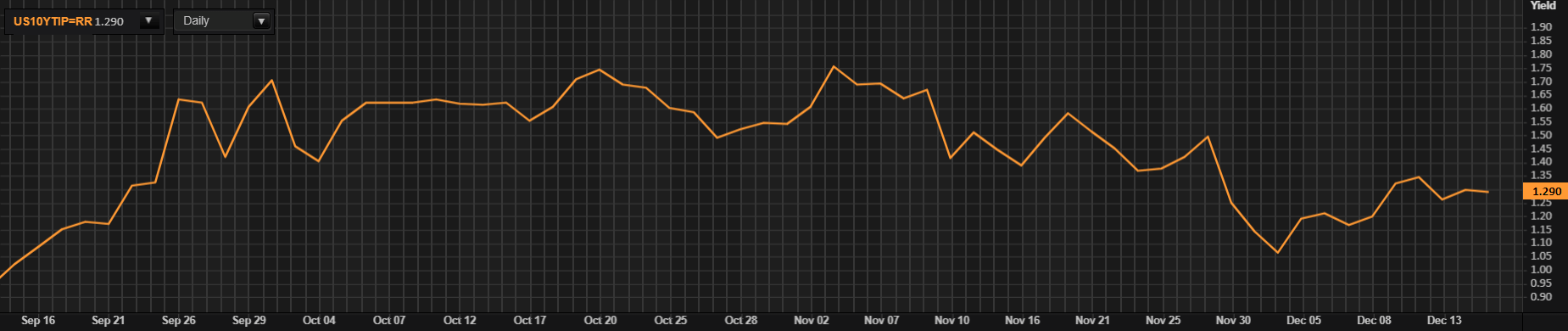

Summing up the current backdrop including a high interest rate environment coupled with softening inflation gives us a declining real yield (refer to graphic below). Considering gold is contentiously branded to some as an ‘inflation hedge’, both variables are currently moving in favor of lower gold levels.

US 10-Year Real Yield