In our live Trading Room Webinars on the principles of Money Management, we often receive questions on one of its key tenets…a 1:2 Risk Reward Ratio.

Keep in mind that a Risk Reward Ratio is nothing more than where a trader places their stop and limit relative to their entry. For a 1:2 RRR, whatever amount the trader is risking based on their stop placement, double that amount and set that as your limit.

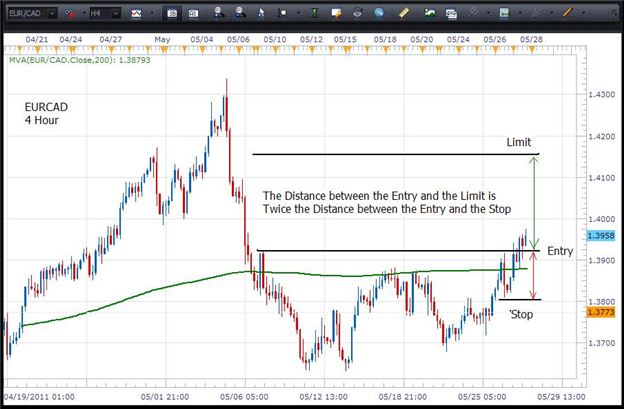

Take a look at the 4 hour chart of the EURCAD below...

Let's say that we entered the trade based on a break above resistance at 1.3925. A prudent stop could be placed at the point on the chart labeled Stop...roughly at 1.3810...115 pips below our entry. So the trader would double the 115 and we have 230. So we would add 230 pips above our entry price and we would have 1.4155. Which is roughly the area where we have our limit labeled on this chart.

For a 1:2 RRR, it all boils down to seeking to gain twice the amount we are risking on a trade.

Next: Risk Reward Ratio Validation (40 of 48)

Previous: Just One of a Thousand Insignificant Little Trades