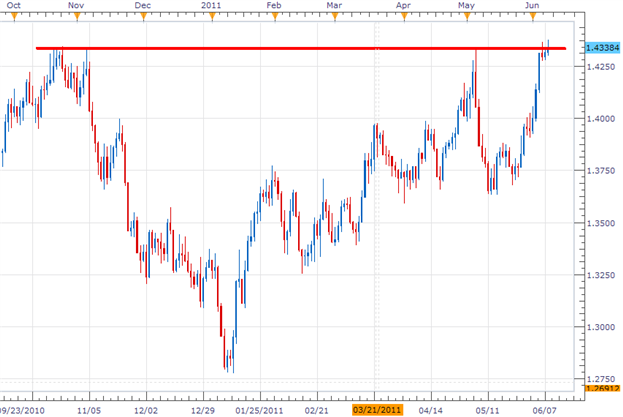

The EUR/CAD is currently challenging previous highs established at 1.4347 in October of 2010. The pair has been in an established downtrend dating back to 2008 however new lows have not been established yet in the 2011 trading year. Resistance has now been tested three times and traders are looking for a break of resistance or a retracement back to established support at 1.3660.

The Canadian Dollar is often associated with oil prices due to its heavy correlation with crude. With the recent sell off in oil over the past two months the CAD has suffered weakness against most major currencies during this time period. Likewise, the Euro Zone has continued bad news in regards to their ongoing monetary crisis. Fundamentally the EUR/CAD pair could tilt either way dependent on how the market interprets the smoke signals issued from these two economies.

Price Action

Taking price in to a 4Hr chart we can see resistance currently being tested near 1.4340. This point also coincides with resistance established on the daily chart in October of 2010. Currently with price trading in a range, if resistance is respected this opens up a return down to current support at 1.3660. If price yields and breaks above this level, our next price resistance is established at 1.5033.

Trading O pportunity

My preference is to set an entry to sell the EUR/CAD if resistance continues to hold, and price trades below our previous low. Entry orders should be placed under 1.4270 at the June 6th low. Stops should be placed in total of ½ the range we are trading up to the1.4570 level. Profit targets will look at the bottom of our range near 1.3670 for 600 pips profit.

Alternative scenarios include trading a break higher above current resistance levels.

Walker England contributes to the Instructor Trading Tips articles. To receive more timely notifications on his reports, email [email protected] to be added to the distribution list.