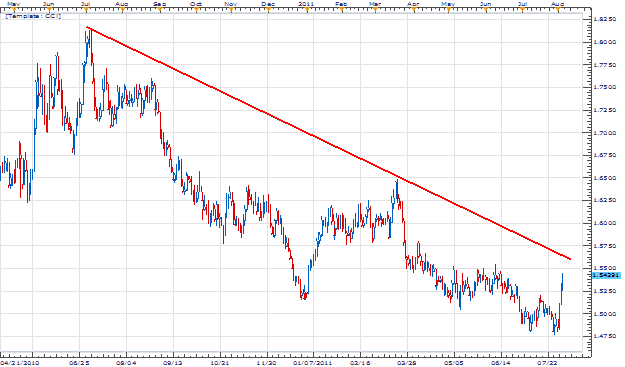

The GBP/AUD continues to be one of the most graphically impressive downtrends in the Forex market. From the July 2010 high at 1.8140 the pair has trended lower to 1.4758 established on July 28th of this year. Despite moving over 3300 pips lower in the last twelve months, this week has brought upon new buying from news out of the RBA (Reserve Bank of Australia).

Yesterday, the RBA opted to hold their lending rates flat at 4.75%. Citing recent world wide economic developments, the bank is now opting for a more neutral / cautious approach to their policy. Despite this less aggressive policy, Australia still maintains one of the highest yielding currencies in the market. As money continues to seek the highest rate of return, it is fully expected for the GBP / AUD trend to continue.

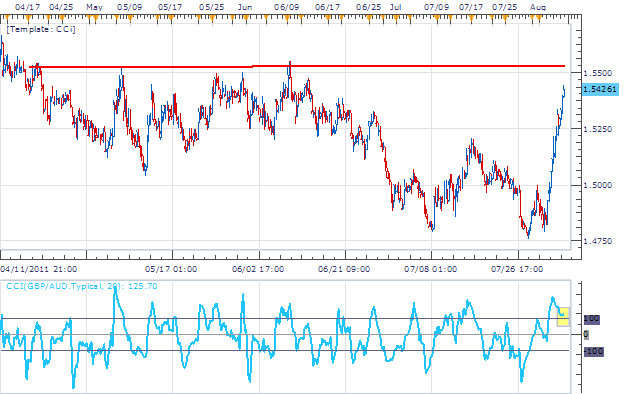

Price Action

Moving to a 4H chart, price has noticeably retraced against its long standing trend. As price tests resistance near 1.5540, we will begin looking to resume looking for selling opportunities. Using the CCI oscillator , we can wait for the indicator to turn under the +100 ( overbought ) levels to indicate a turn in price. Only at this point will we look to resume trading with the trend.

Trading O pportunity

My preference is to sell the GBP/AUD on a turn of the CCI indicator under the +100 signal line. Entrys should be placed as near as possible to resistance at 1.5540. Stops should be placed at 1.5680 or better. Limits should target 1.5260 at minimum looking for 280 pips profit, setting up f a clear 1:2 Risk/Reward ratios.

Alternative scenarios include price continuing to trade between our triangle lines.

Walker England contributes to the Instructor Trading Tips articles. To receive more timely notifications on his reports, email [email protected] to be added to the distribution list.