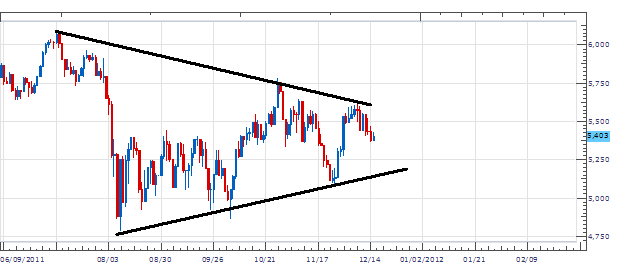

The UK100 ( FTSE ) is an interesting exchange that has moved as much as 21% lower after printing its 2011 highs at 6,109 on April 27th. However, since our low was set in place at 4,783 on August 9th, the UK100 has been in consolidation mode. Moving in a triangle pattern, a higher high or a lower low has yet to be seen for four months. With a lack of market direction, as price pings between support and resistance, traders should consider the “inside bar” strategy discussed in today’s Plus webinar and December 9ths Chart Of the Day .

Staying on our Daily chart for the UK100, we will find price trading today inside of yesterdays low and high. These levels reside at 5,470 and 5,363 respectively. Traders may use an OCO* entry at these levels to trade a breakout of either point. Stops and limits may also be managed again by using the ATR indicator.

ATR is an indicator that monitors volatility buy comparing the open and closing data on our chart. Today ATR is reading at 122, meaning that the pair has traveled an average of 122 points from open to close over the last 14 daily trading periods. My recommendation is to use 20% of ATR for our stop/limit levels.

My preference is to sell the UK100 using Entry orders. Entry’s should be set to buy over 5,470 (previous high) and to sell under 5,363 (previous low). Stops and limits should be set 25 points away, in line with 20% of ATR.

Alternative scenarios include continued consolidation before a breakout of entry levels.

Additional Resources

*For more information on placing OCO, Stop and Limit orders on FXCMs trading platform, join us for a software demonstration linked below.

Daily Software Demonstrations

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.