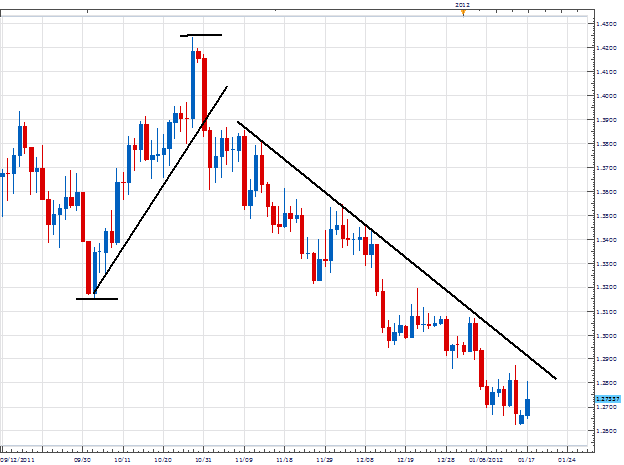

The EUR/USD is sizing up to be one of the best trending pairs of 2012. The pair has declined over 1622 pips from its October 2011 high at 1.4246. Today’s price action has brought the EUR / USD off of its yearly lows at 1.2624. As the pair retraces, astute trend traders will utilize the opportunity to establish fresh short positions.

Traders will keep their eye on the Economic Calendar , for upcoming news events that may add momentum to the trend. Friday, is set for the release of German Producer Prices . This number is considered an early sign of inflation, which ultimately affects their central bank’s policy.

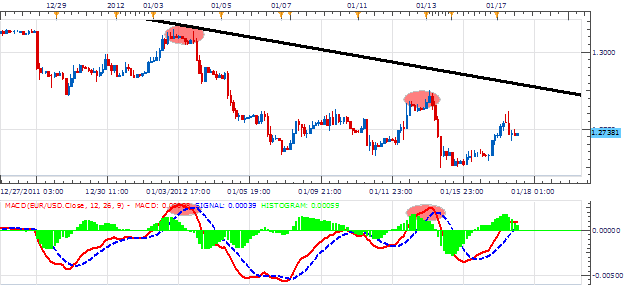

Moving to our 2Hour chart, we can see the continuation of our trend. Oscillators can be a great way to time your entry’s with the trend. Below, we will see two previously set entrys using the MACD indicator. Traders should again wait patiently for entry as the MACD line crosses the signal line to enter our trade. Stops should be set above the previous high, with limits looking for the creation of lower lows on the pair.

My preference is to sell the EUR/USD on a MACD crossover. Entrys are expected to be near 1.2700. Stops should be placed at the previous high above 1.2800. Our limits should be set at 1.2500 or better for a clear 1:2 Risk/Reward ratio.

Alternative scenarios include price breaking higher toward resistance near 1.2880.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.