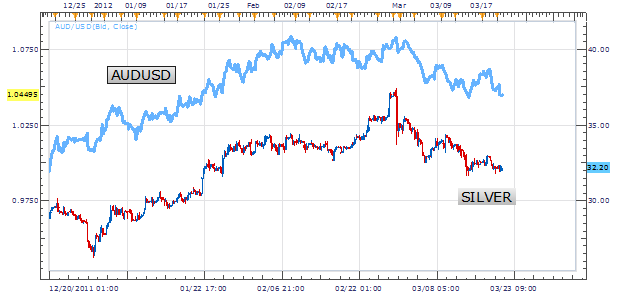

Yesterday’s March 20 th Chart of the Day, focused on trading Silver on a breakout to the downside. Having a market bias on commodities such as gold and silver can be influential to the currency pairs we trade as well. Below we have an overlay of the AUD/USD currency pair and Silver. From resent research these pairs are holding over an 86 % positive correlation over the last week. This implies from our previous analysis if silver is set to move lower, we can reasonably expect the AUD / USD to do the same.

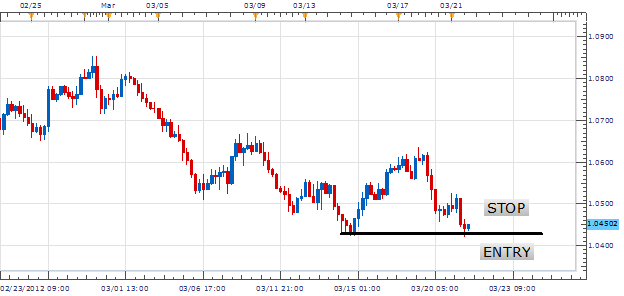

Moving price into a 4Hr chart on the AUD/USD we can find support now holding under the 1.0420 pricing level. This level was tested early this morning after a two day decline of over 185pips. Traders again may take advantage of a breakout strategy on the collapse of support. Preference for entry should be given on a bar closing below 1.0420 or standard entry orders may be used. Stops may be placed above old support / new resistance at 1.0520.

My preference is to sell the AUD/USD under 1.0420. Stops should be set near 1.0520. Primary limits should look for a minimum of 200 pips at 1.0220 for a 1:2 Risk/Reward ratio. Secondary targets may assume a move closer to parity.

Alternative scenarios include price breaking over daily resistance to new highs over 1.0620.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.