Summary: In this article, we attempt to look at the psychological elements of trade, risk, and money management as presented in the Traits of Successful Traders research series.

The goal of trading is to make money by forecasting future price movements.

This is inherently difficult because, as human beings, we cannot tell the future.

Surely many new traders analyze data announcements, or economic reports with the goal of buying cheaply before prices may run up, or selling ‘expensive’ before prices move lower; but those traders will often soon find out that consistent profitability is considerably more difficult than ‘out-guessing’ the market.

In this article, we’re going to approach a psychological road-block that many new traders struggle with in their effort to find consistent profitability.

Defining Trading Success

Human beings naturally recognize patterns. It’s an evolutionary trait; if a man or woman were to wander out of a cave only to get eaten by a bear, others in that cave should grow cautious of leaving.

We attach emotions to results because that’s the best way to move towards success, whatever the pursuit may be.

In trading, this often entails feeling good when we win, or feeling bad when we lose. This is the stimuli that guide our future patterns and decision making processes. But is this the best way for a trader to approach the market; hinging their decisions on what may feel ‘best?’

It’s Not How Often You are Right that Matters

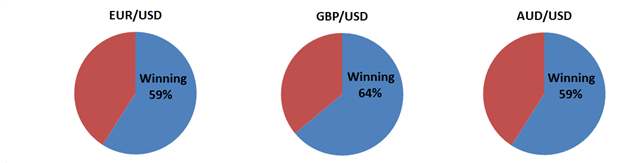

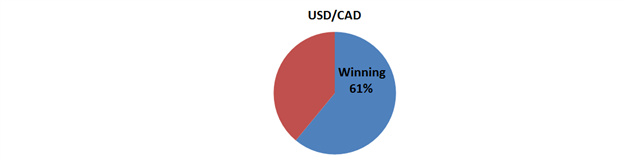

This is something we found in the Traits of Successful Traders research . Despite the fact that traders, on average, lost money – they still won well over half of the time in most currency pairings. Below, we take a look at the average winning percentage in the major currency pairs:

Winning percentages in the Major Currency Pairs; as shown in The Number One Mistake FX Traders Make , by David Rodriguez

Think about these winning percentages for a moment. These traders had that feeling of jubilation that comes from a winning trade more often than they had the feeling of failure after taking a loss.

So, despite the fact that traders lost money, on average, in these pairings, they still ‘felt’ like they were successful.

Is Feeling Successful More Important than Being Successful?

Just as the title of this article states, default human nature – that which runs towards pleasure but away from pain is the same thing that makes it so difficult for new traders to learn to trade.

And the reason for that is what happens on a per trade basis…

Remember, the traders above – while they felt successful more often than they felt failure – they were still losing money. So, they were still, on average, facing failure.

And the reason for this is because of what happens on an individual, per-trade basis.

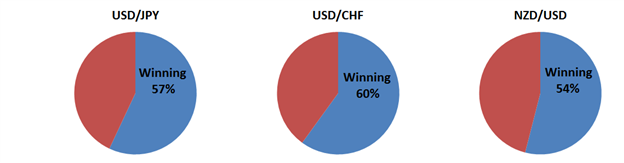

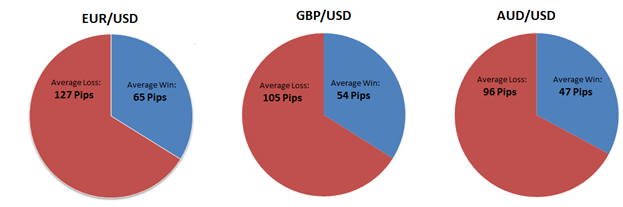

In the Traits of Successful Traders research that we referenced above, we wanted to find the reason that traders were losing money despite the fact that they were winning over half the time; and the answer is below:

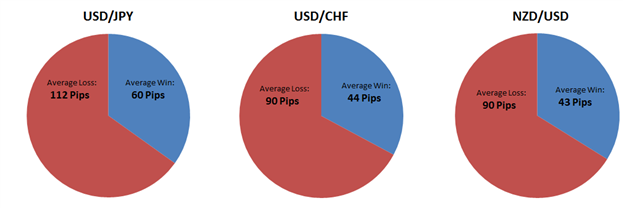

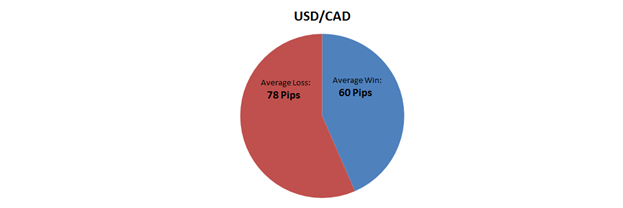

Win/Loss ratios in the Major Currency Pairs; as shown in The Number One Mistake FX Traders Make , by David Rodriguez

As you can see in the above series of pie charts, traders lost, in many cases, significantly more when they were wrong, than they won when they were right.

And this is precisely how human nature can work against us as traders. When we get a losing position, we want to wait it out, hoping that prices come back so that we don’t have to take a loss. We desire that ‘feeling’ of success as opposed to thinking of the bigger picture, and the fact that this trade that has already shown us a loss has the potential to show us an even bigger loss.

And when we do get a winning position, that same human nature comes into work against us. We watch the position with fear, hoping that this gain doesn’t turn around and become a loss. So, we have a tendency to close these positions really fast in an effort to prevent a winner from becoming a loser…. Once again, allowing our actions to be driven and directed by that desire to ‘feel’ successful.

How can we beat our own Human Nature?

While beating human nature in a larger context may be considerably more difficult than we can propose to counter in this article, doing so in trading can be quite a bit easier to implement.

First and foremost – just as David Rodriguez had outlined in The Number One Mistake that Forex Traders Make , look for minimum risk-reward ratios of 1-to-1 or better; or put more simply, only enter trades in which you can make more than you stand to lose.

Secondly, remember that any given trade that you place is unlikely to be anything more than just one of a thousand insignificant trades that you place in your career .

And third, don’t expect that you are going to ‘out-guess’ the market… because it likely won’t happen.

If this is challenging, place a stop and a limit on the trade to enforce this minimum 1-to-1 risk-to-reward ratio, and let the trade work. You can add or program for a break-even stop, or a pre-determined stop movement; but at all points – Plan your trade, and trade your plan .

-- Written by James Stanley

James is available on Twitter @JStanleyFX

To join James Stanley’s distribution list, please click here .

Want to learn more about Mirror trader? Join us for a live

walkthrough Wednesdays at 3PM Eastern Time.

We’ve recently begun to record a series of Forex Videos on a variety of topics. We’d greatly appreciate any feedback or input you might be able to offer on these videos:

New to the FX Market ? Save hours in figuring out what Forex trading is all about.

Take this free 20 minute ‘New to FX’ course presented by Education. In the course, you will learn about the basics of a Forex transaction, what leverage is, and how to determine an appropriate amount of leverage in your trading.

Register HERE to start your Forex Trading Education now.