Talking Points

- Why is a Central Bank’s Monetary Policy Important for Forex Traders?

- Where do Central Banks Monetary Policy Currently Stand?

- What Trades Are Attractive Pairings of Monetary Policy Imbalance?

Trading the Forex market places an unusual emphasis on Central Bank policy and rate announcements that isn’t as common in other markets albeit still very important. The effect that monetary policy has is paramount to currency outcomes and can be a major determinant in what trades you decide to place. Because monetary policy is the process by which a monetary authority like a central bank controls the supply of money within an economy in order to support economic goals.

Why is a Central Bank’s Monetary Policy Important for Forex Traders?

As a trader, it’s always important to recognize where a trade opportunity lies. One of the cleanest fundamental set-ups is when you have one central bank that is looking to tighten money supply due to an overheating economy which shows underlying strength and another economy’s central bank that is looking to loosen monetary policy which weakens the currency in order to jump start the economy.

On the other end, if you have two central banks with very similar monetary policy goals then the trade set-up may not be as clear.

This clear imbalance or disparity between to economies central bank policies makes this an important distinction for you to be aware of for trading purposes especially when price action aligns with the fundamental imbalance . The rest of this article will break down where central banks currently stand and what opportunities lie within the imbalances. Furthermore, if this is information that you find helpful as I believe it will, then we can make this an ongoing piece for you and your trading.

Where do Central Bank ’ s Monetary Policy Currently Stand?

Federal Reserve – US DOLLAR

Presented by FXCM’s Marketscope Charts

The big stories behind the US DOLLAR and their central bank are the changing of the guard where Janet Yellen will take over for Ben Bernanke as head of the Fed as well the eventual taper of current easing efforts. Since July of this year, the USDOLLAR has weakened significantly as the underlying measures of economic health like inflation and employment have not improved enough for the Fed to confidently begin tapering their easing efforts. Also of importance, Janet Yellen, the new head of the Federal Reserve starting in 2014 has asserted that she will continue to be accommodative and work not to begin tapering, which would be US Dollar positive, until the underlying economic indicators show continuance strength.

Bottom Line: The US Dollar may continue to trade lower and retest the price channel floor or possibly break it as The US Dollar remains comparatively weak to other major currencies.

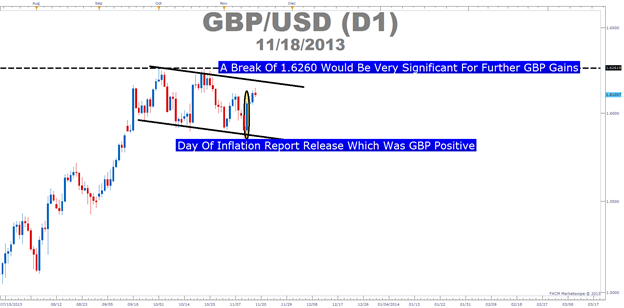

Bank of England – GBP

Presented by FXCM’s Marketscope Charts

As of last week, the Monetary Policy Committee of the Bank of England have recently upgraded their forecasts of an economic recovery in their inflation report. A few weeks earlier, BoE governor, Mark Carney, mentioned that he would be looking for an improvement in key economic indicators before they looked to tighten their current monetary policy.

Bottom Line: The inflation report upgrade last week seemed to be the signal the market wanted as the GBP is now seemingly lead other economies out of the 2008 crisis which weakened many major currencies. A break of 1.6260 would be a key technical development for further GBP Strength.

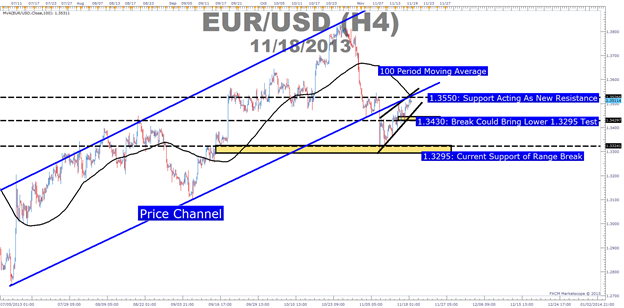

European Central Bank – Euro

Presented by FXCM’s Marketscope Charts

The market was shocked two weeks ago when the ECB decided to cut their already historically low central bank reference rate to 0.25%. This move was on the back of a paltry inflation reading which showed current inflation, which is an elementary reading of economic demand was at lows not seen since after the 2008 credit crisis and 2010 Sovereign crisis when Greece came to the forefront. This cut of interest rates has many looking to the December meeting of the ECB to provide further clarity on how weak the Euro may become.

Bottom Line: The euro faces one of its most uncertain fates in the last 3 years. It appears the sole focus of the ECB on inflation will cause them to fight the foe of disinflation which could keep the Euro under pressure for months to come.

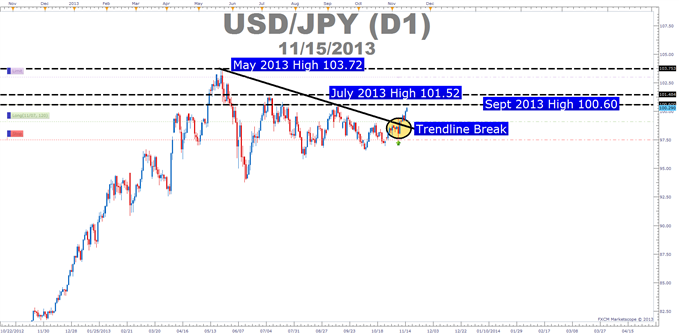

Bank of Japan – JPY

From Article: Finding JPY Targets in Strong Trends

Over the last year, Japan has led global currency wars in order to get their economy out of 20-year deflationary downward spiral. The current effort led by new Prime Minister, Shinzō Abe, appears to be their most successful attempt yet. The efforts are expected to continue to put downward pressure on the JPY as JPY crosses like USDJPY & GBPJPY continue to look at higher targets.

Bottom Line: The JPY will likely continue to fall as the Bank of Japan puts further measures in place to weaken the JPY and make their exports more attractive.

Reserve Bank of Australia – AUD

Presented by FXCM’s Marketscope Charts

RBA governor Glen Stevens has recently been on record multiple times talking about the challenge of an “uncomfortably high Australian Dollar”. The release of the November minutes this week will continue to echo this theme which will likely keep the Australian dollar under pressure for months to come. The purpose of this rhetoric from Governor Stevens is that Australia is in the midst of efforts to decouple their reliance on China’s economic peaks and troughs.

Bottom Line: As the RBA works to get their economy to stand on their own two feet, the central bank may look to take further measures to allow a weaker Australian Dollar to give an edge to their exports. Given that they’re still very exposed to China, further data releases like PMI could also weigh on the Australian dollar against relatively stronger currencies like the New Zealand Dollar , Great Britain Pound and US Dollar in the near term.

What Trades Are Attractive Pairings of Monetary Policy Imbalance?

When deciding which trades look most attractive, it may be best to look at opposite ends of the spectrum. In other words, which major currency is looking to raise rates due to significant and recent economic progress? The answer to that question would be the currency that you’d look to buy other currencies against. The other side of the spectrum would have you asking yourself which central bank and their relative currency is likely going to be under pressure due significant and recent negative economic prints relative to expectations.

Across the board, it’s hard not to view the GBP and possible the US Dollar as clearly the more favorable currencies in light of Central Banks. The US Dollar would become more favorable if you see data start to surprise to the upside relative to expectations like we’ve been seeing for the GBP.

Conversely, it looks like the Australian Dollar, Japanese Yen and possibly, the Euro will continue to stay under pressure. If the market believe that the ECB can weaken the Euro to battle the poor inflation readings then you could expect EURGBP & EURUSD to remain under pressure in coming months as the outlook between theECB and the BoE continues to diverge. GBPAUD and GBPJPY could also be favorable trades if we continue to get wording from the RBA & BOJ that their main concern is an elevated domestic currency.

Bottom Line:

Central Banks can provide critical insights to Forex Traders. If you have a hard time deciphering what is the current layout of monetary policy and their equivalent trade set-ups, we have a special offer for you below. However, it can often come down to asking yourself the two questions and finding a disparity between the strongest and weakest currencies .

Happy Trading!

---Written by Tyler Yell, Trading Instructor

To contact Tyler, [email protected]

To be added to Tyler’s e-mail distribution list, please click here.

As a dedicated FX Trader, would you like the following?

- Faster access to fundamental releases that is likely to move the markets

- Feedback on market movements in real time

- Real time Speculative Sentiment Index Readings

If so, our Real-Time on Demand is a fee based service that gives you access to our professional trading staff from 6am – 2pm ET Every trading day so you can get feedback on your trade setups and ideas.

However, you can email me at [email protected] if you’d like to trial one day in November at no cost.