Talking Points

- GBPUSD Opens to Higher Highs

- Event Risk may Increase Volatility

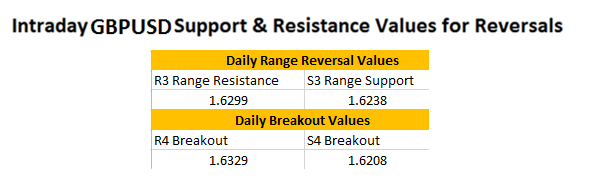

- Bearish Reversal Signaled Under 1.6329

GBPUSD 30min Chart

(Created using FXCM’s Marketscope 2.0 charts)

Suggested Reading: Trading Intraday Market Reversals

The GBPUSD continues to be in focus this week, with today’s event risk revolving around the conclusion of the Scottish independence referendum . Running into the London close, the GBPUSD has broken to a higher highs over its R4 camarilla pivot. Price is now trading well above the R4 pivot, with breakout traders first focusing on a 1x extension of the camarilla pivot range to a price of 1.6390. If current momentum trends continue, traders may also select to initiate new buy positions.

As in any trading scenario revolving around the news, price may reverse on increased volatility. A move back under today’s R3 range resistance pivot at 1.6299 would signal a strong change in market conditions. Traders would then look at the possibility of a move back to initial price support at 1.6238 and then a further reversal below final support at 1.6208

Yesterdays Update

Yesterday, the USDJPY opened the U.S Trading session testing key values of resistance. During the highly anticipated FOMC news event, price quickly broke above R4 resistance at 107.40. Overnight prices rose even further, with the USDJPY now trading over 100 pips higher. To learn more, check out yesterday’s FX Reversal article linked below.

FX Reversals: AUDUSD Reversal Range Update

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.