Talking Points

- USDCHF Opens in a 38 Pip Range

- Range Resistance Sits at .9437

- Range Reversals Triggered Under .9418

USDCHF 2Hour Chart

(Created using FXCM’s Marketscope 2.0 charts)

Looking for more FX Reversals? S ign up for my email list here: SIGN UP HERE

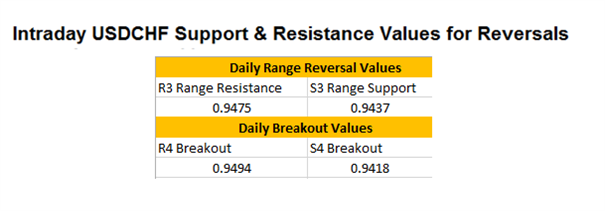

The USDCHF currency pair has opened Mondays trading moving inside of a defined 38 pip range. Price first tested resistance at the R3 pivot at a price of .9475 early in the session, but failed to break towards a higher high. From this point, price quickly moved to range support, seen above at the S3 pivot at a price of .9437. With the USDCHF currently bouncing off of support, traders can continue to initiate new positions as long as the mentioned support and resistance values stay valid.

If lines of support and resistance fail to contain price, traders can look to take advantage of a market breakout. A price break above the R4 pivot at .9494 would give credibility to a longer term bull reversal on the creation of a higher high. If price drops below the S4 pivot at .9418, this would suggest further weakness for the US Dollar relative to the Swiss Franc . In either breakout scenario, traders should look to conclude any range bound opportunities while looking to trade with the markets new chosen direction.

Suggested Reading: Trading Intraday Market Reversals

Practice setting up orders using Camarilla Pivots, register for a FREE Forex demo with FXCM. This way you can develop your day trading techniques while tracking the market in real time.

Click HERE to Register Now

---Written by Walker England, Trading Instructor

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

To contact Walker, email [email protected] .

Contact and Follow Walker on Twitter @WEnglandFX.