Euro (EUR/USD) Analysis and Charts

- French bond yields remain near multi-month highs

- Euro on hold ahead of high impact events

Download the brand new Q3 Euro forecast below:

The Eurozone economy continued to grow at the end of the second quarter, although momentum was lost as the expansion cooled to a three-month low, according to the latest HCOB Eurozone Composite PMI. The latest survey data highlighted a cooling of price pressures across the euro area. Rates of increase in input costs and output prices cooled to five- and eight-month lows, respectively, but remained above the pre- pandemic trends.

Commenting on the PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank (HCOB), said: “ Growth in the Eurozone can be attributed fully to the service sector. While the manufacturing sector weakened considerably in June, activity growth in the services sector continued to be nearly as robust as the month before. Considering the upward revision versus the preliminary flash PMI figures, the chances are good that service providers will remain the decisive force keeping overall economic growth in positive territory over the rest of the year."

For all market-moving data releases and events, see the FB Finance Institute

Euro traders are waiting for the outcome of the second round of the French election this Sunday. The National Rally (RN) continues to lead the polls but remains unlikely to get the 289 seats needed for an absolute majority. At the start of the week, the RN party was seen securing 280 seats and this seems unlikely to change as various centrists and left-wing parties band together to stop an RN majority. This would lead to a very uneasy alliance that would see French government bond yields move ever higher.

French 10-year Bond Yield

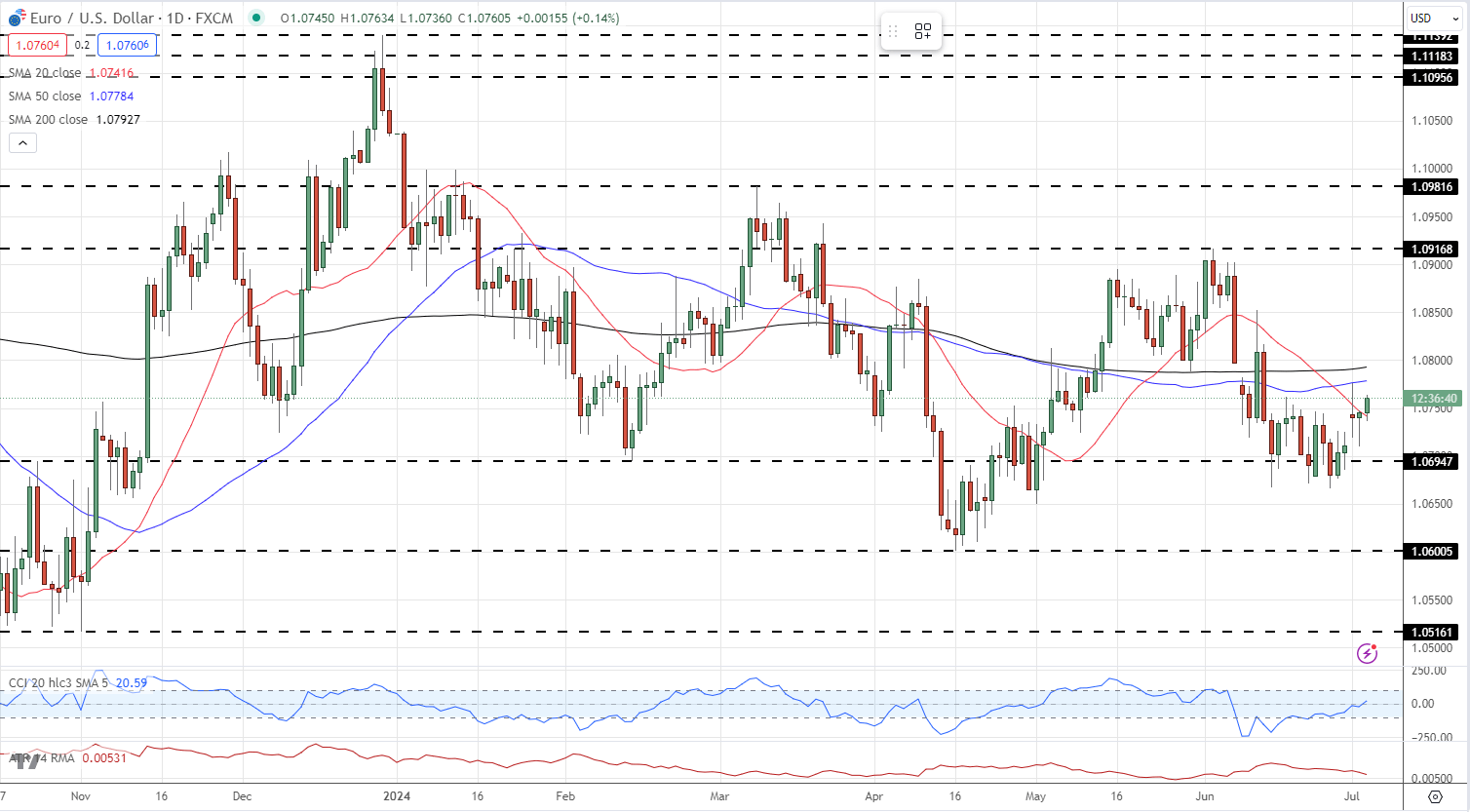

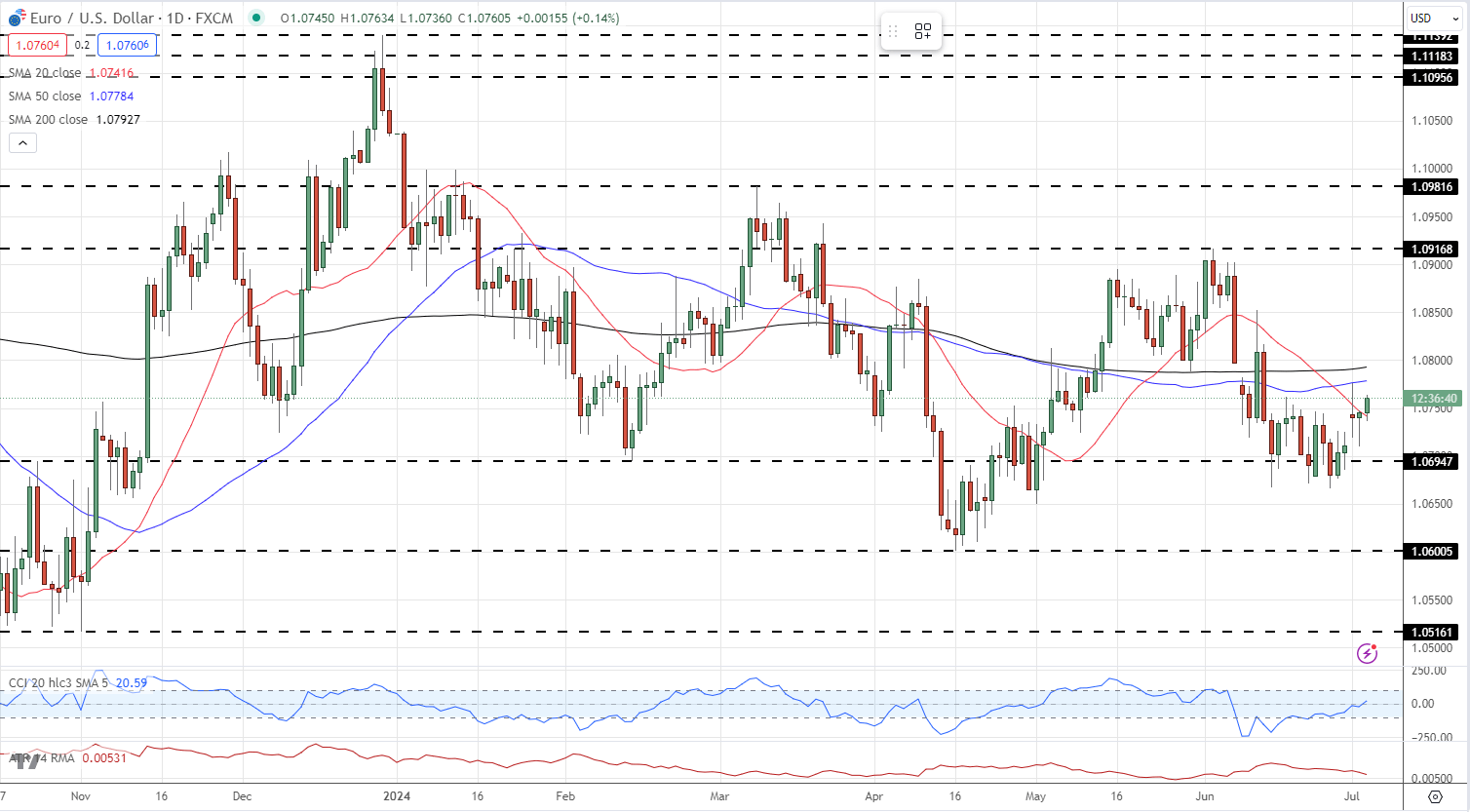

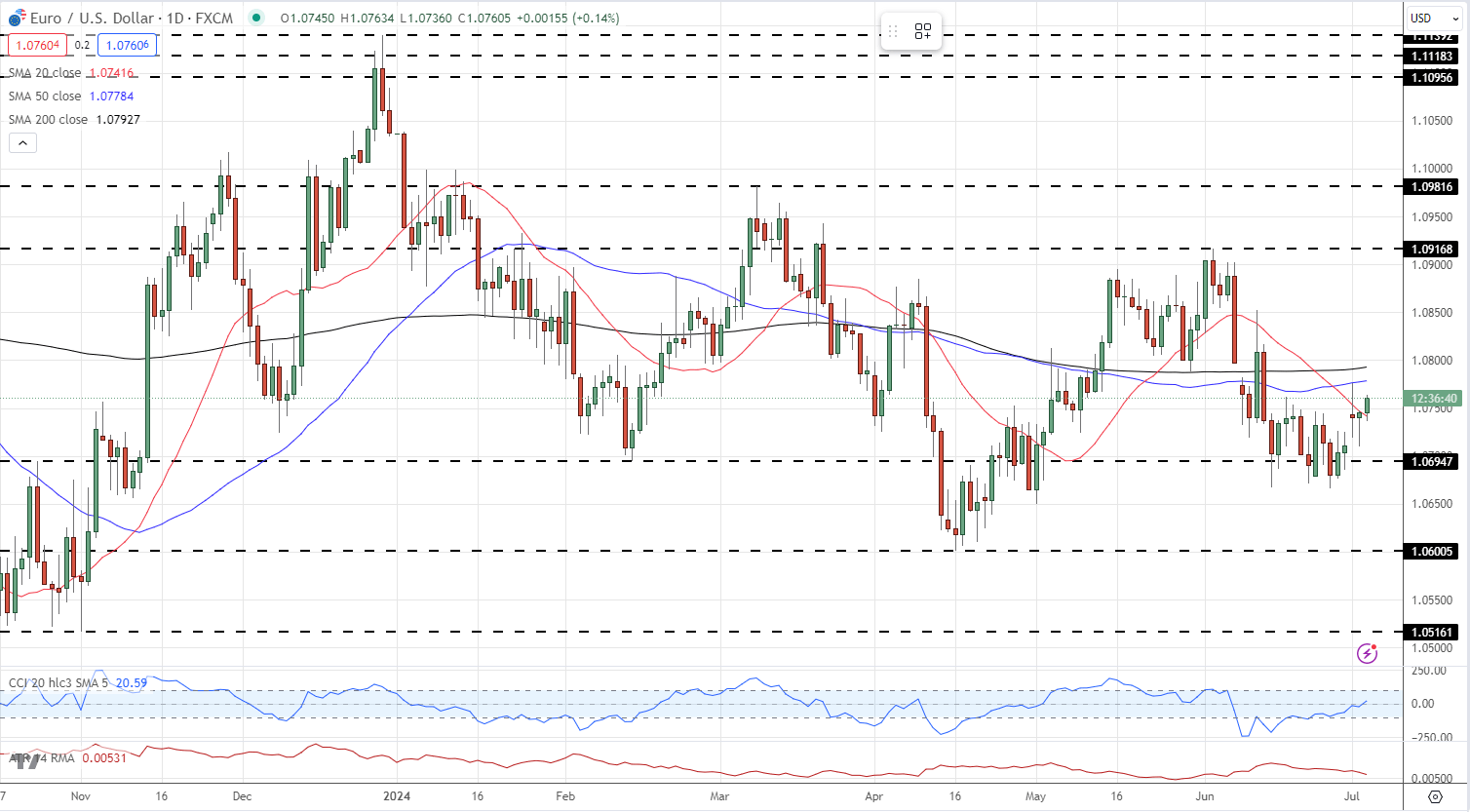

Euro traders will also be on guard for Friday’s US Jobs Report ( NFPs ), a known market mover and driver of short-term volatility. A multi-month sequence of lower highs and lower lows remains in place and for this pattern to continue, EUR/USD needs to trade below 1.0600. Short-term resistance is seen at 1.0800 with support at 1.0665.

EUR/USD Daily Price Chart

All charts using TradingView

Retail trader data show 50.44% of traders are net-long with the ratio of traders long to short at 1.02 to 1.The number of traders net-long is 4.57% lower than yesterday and 17.19% lower than last week, while the number of traders net-short is 8.71% higher than yesterday and 16.30% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/ USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

| Change in | Longs | Shorts | OI |

| Daily | -29% | 23% | -5% |

| Weekly | -46% | 69% | -8% |