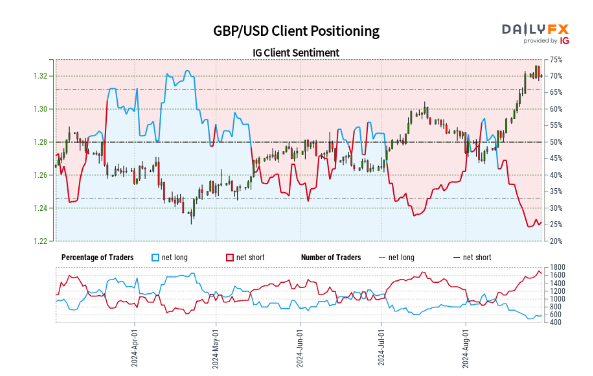

EUR/USD Analysis

Current Position:

- 30.60% of traders are net-long (buying)

- 69.40% of traders are net-short (selling)

- The ratio of short to long positions is 2.27 to 1

Changes in Long Positions:

- Increased by 20.19% since yesterday

- Increased by 44.60% since last week

Changes in Short Positions:

- Decreased by 5.87% since yesterday

- Decreased by 3.33% since last week

Market Interpretation:

- We generally take a contrarian view to crowd sentiment.

- The current net-short position suggests EUR/USD prices may continue to rise.

- However, traders are becoming less net-short compared to yesterday and last week.

- These recent changes in sentiment suggest caution in predicting further price increases.

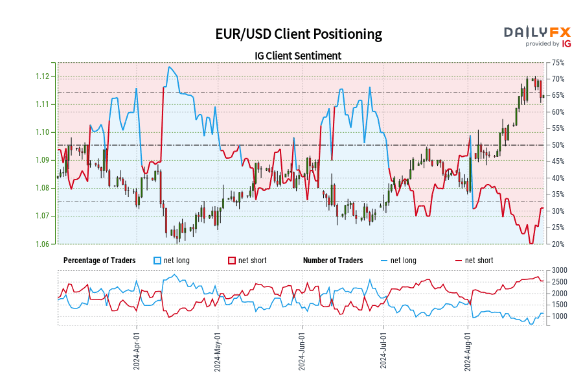

GBP/USD Analysis

Current Position:

- 25.81% of traders are net-long (buying more than selling)

- The ratio of short to long positions is 2.88 to 1

Recent Changes:

- Net-long traders:

-

- Increased by 3.41% since yesterday

-

- Decreased by 6.04% since last week

- Net-short traders:

-

- Decreased by 3.21% since yesterday

-

- Increased by 13.11% since last week

Analysis: We usually interpret crowd sentiment in a contrarian manner. Since traders are predominantly short, this suggests GBP/USD prices might rise.

However, the sentiment is mixed:

- Compared to yesterday: Slightly less bearish (fewer short positions)

- Compared to last week: More bearish (more short positions)

Conclusion: Due to the conflicting short-term and medium-term trends in trader sentiment, our trading bias for GBP / USD is mixed