US GDP, US Dollar News and Analysis

- US Q2 GDP edges higher, Q3 forecasts reveal potential vulnerabilities

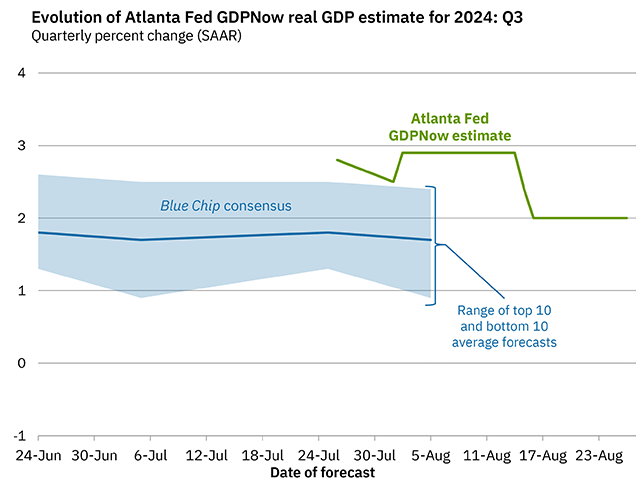

- Q3 growth likely to be more modest according to the Atlanta Fed

- US Dollar Index attempts a recovery after a 5% drop

US Q2 GDP Edges Higher, Q3 Forecasts Reveal Potential Vulnerabilities

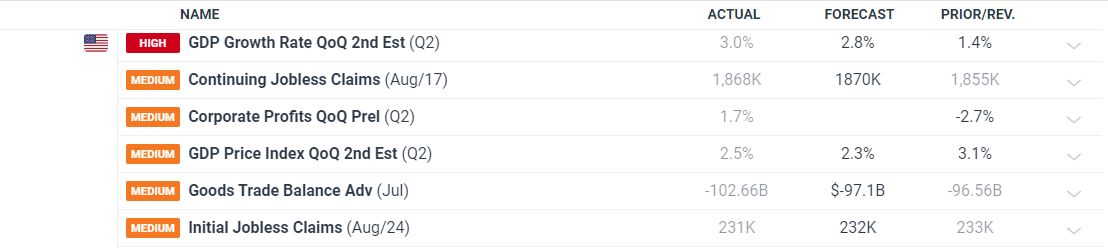

The second estimate of Q2 GDP edged higher on Thursday after more data had filtered through. Initially, it was revealed that second quarter economic growth grew 2.8% on Q1 to put in a decent performance over the first half of the year.

The US economy has endured restrictive monetary policy as interest rates remain between 5.25% and 5.5% for the time being. However, recent labour market data sparked concerns around overtightening when the unemployment rate rose sharply from 4.1% in June to 4.3% in July. The FOMC minutes for the July meeting signalled a general preference for the Fed’s first interest rate cut in September. Addresses from notable Fed speakers at this month’s Jackson Hole Economic Symposium, including Jerome Powell, added further conviction to the view that September will usher in lower interest rates.

The Atlanta Fed publishes its very own forecast of the current quarter’s performance given incoming data and currently envisions more moderate Q3 growth of 2%.

Richard Snow

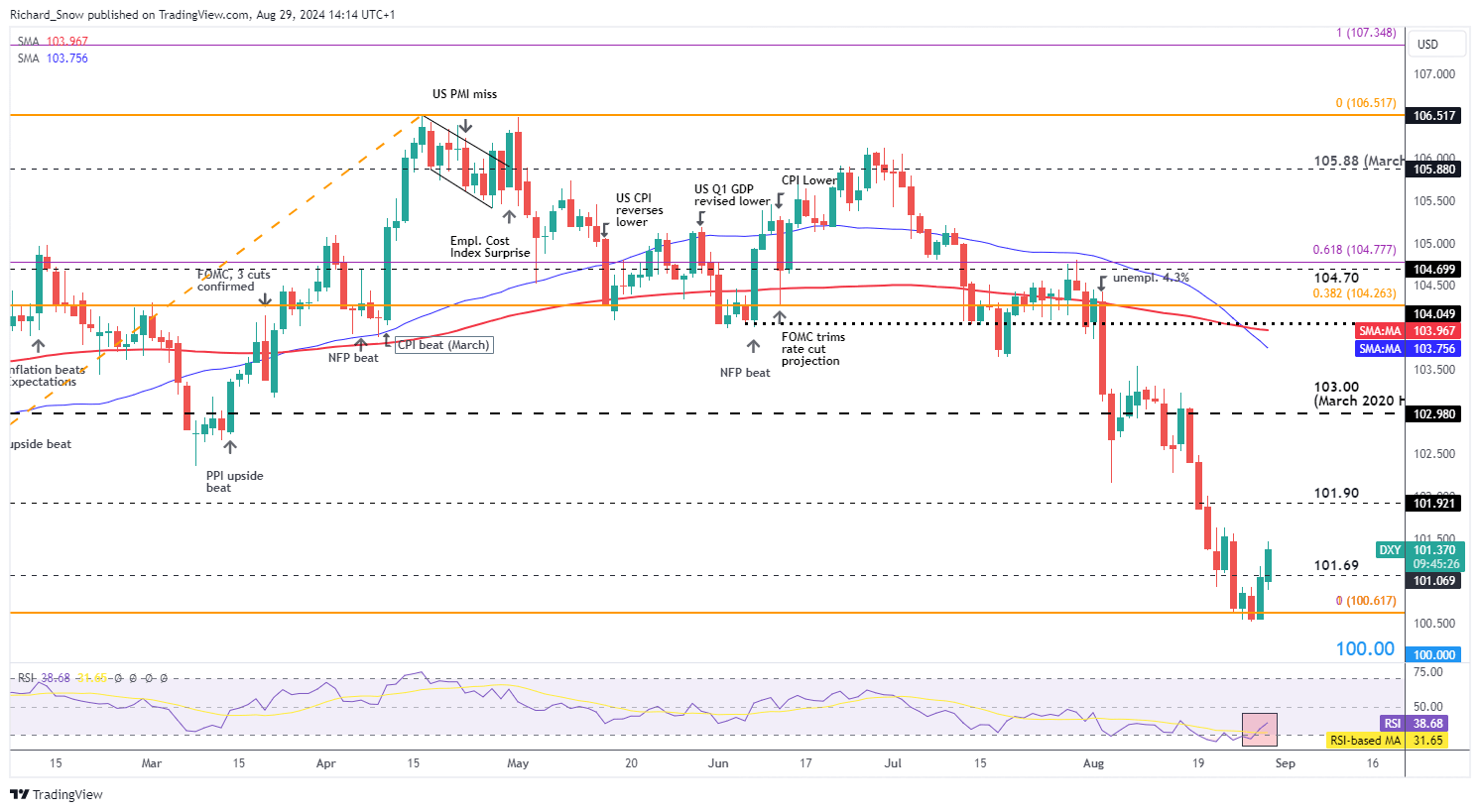

The US Dollar Index Attempts to Recover after a 5% Drop

One measure of USD performance is the US dollar basket (DXY), which attempts to claw back losses that originated in July. There is a growing consensus that interest rates will not only start to come down in September but that the Fed may be forced into shaving as much as 100-basis points before year end. Additionally, restrictive monetary policy is weighing on the labour market, seeing unemployment rising well above the 4% mark while success in the battle against inflation appears to be on the horizon.

DXY found support around the 100.50 marker and received a slight bullish lift after the Q2 GDP data came in. With markets already pricing in 100 bps worth of cuts this year, dollar downside may have stalled for a while – until the next catalyst is upon us. This may be in the form of lower than expected PCE data or worsening job losses in next week’s August NFP report. The next level of support comes in at the psychological 100 mark.

Current USD buoyancy has been aided by the RSI emerging out of oversold territory. Resistance appears at 101.90 followed by 103.00.

Richard Snow