Retail Trader Sentiment Analysis – FTSE 100, GBP/USD, and EUR/GBP

Gauge market dynamics by examining sentiment indicators, position ratios, price fluctuations, and technical signals to determine prevailing bullish or bearish trends.

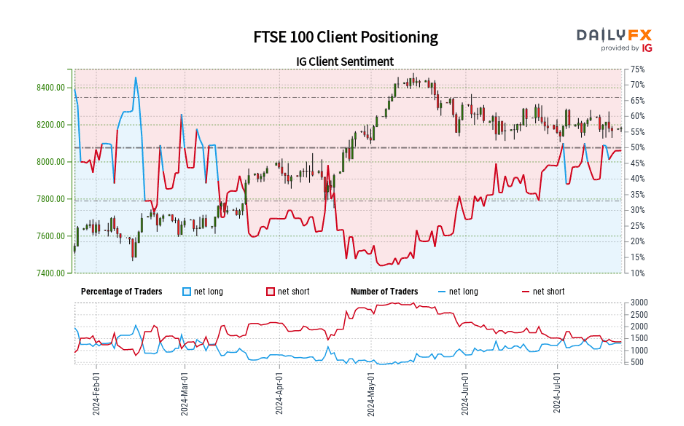

FTSE 100 Retail Trader Data: Mixed Outlook

Analysis of retail trader positioning reveals a slight bearish tilt, with 48.54% of traders holding long positions and a short-to-long ratio of 1.06 to 1. While net-long positions have decreased marginally by 0.85% since yesterday, they've increased by 19.89% over the past week. Conversely, net-short positions have seen a minor 0.44% increase from yesterday but a 15.36% decrease compared to last week. Given our contrarian market sentiment approach, the net-short bias suggests the potential for continued FTSE 100 appreciation. However, the mixed short-term and medium-term positioning shifts indicate a nuanced trading outlook for the FTSE 100.

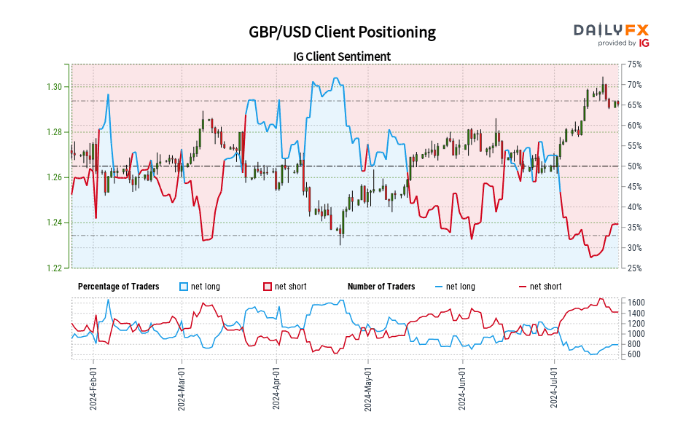

GBP/USD Retail Trader Data: Downside Correction?

Recent retail trader data indicates a strong bearish sentiment, with merely 35.60% of traders maintaining long positions and a short-to-long ratio of 1.81 to 1. Net-long positions have seen a slight 0.90% increase since yesterday and a substantial 29.32% rise over the week. Net-short positions show a minimal 0.28% decline from yesterday and a more significant 9.27% weekly decrease. While our contrarian interpretation of crowd sentiment would typically suggest potential GBP / USD gains given the net-short position, the recent reduction in bearish positioning and increase in bullish sentiment warrant caution. These shifts in trader behavior suggest the current upward trend in GBP/USD may be approaching a reversal point.

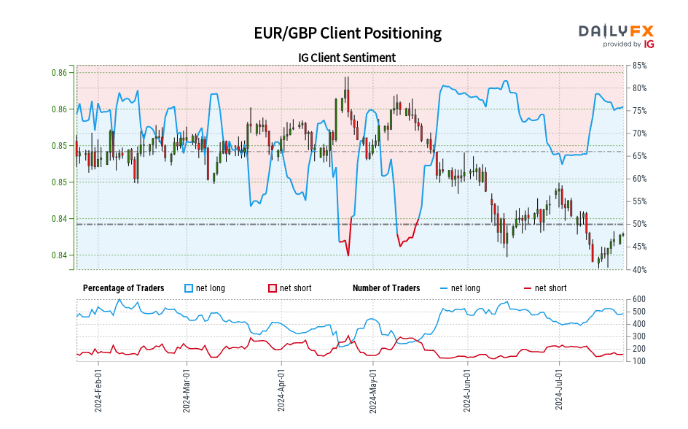

EUR/GBP Retail Trader Data: Reversal Higher?

Recent retail trader data indicates pronounced bullish sentiment, with 75.19% of traders maintaining long positions and a long-to-short ratio of 3.03 to 1. Net-long positions have seen a slight 0.62% increase since yesterday but a 5.09% decrease over the week. Net-short positions show a 2.56% rise from yesterday and a more significant 12.68% weekly increase. While our contrarian interpretation of crowd sentiment would typically suggest potential EUR /GBP losses given the net-long position, the recent growth in bearish positioning and decrease in bullish sentiment warrant caution. These shifts in trader behavior suggest the current downward trend in EUR/GBP may be approaching a reversal point.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 14% | 5% |

| Weekly | -7% | 16% | -2% |