Japanese Yen (USD/JPY) Analysis

- Yen picks up late bid as markets digest Ueda’s comments

- Rising Japanese Government bonds spur on the yen one day after BoJ meeting

- USD/JPY turns away from the 150 mark as 146.50 emerges as immediate support

Yen Picks up a Late Bid as Markets Digest Ueda’s Comments

The main takeaway from yesterday’s Bank of Japan (BoJ) meeting was that Ueda still has his eye on an eventual exit from negative rates despite inflation showing signs of slowing down. Ueda described the likelihood of reaching the 2% target as “increasing” and even said an exit from negative rates is possible in the absence of addressing the current, sub-optimal output gap (difference between potential output and current output).

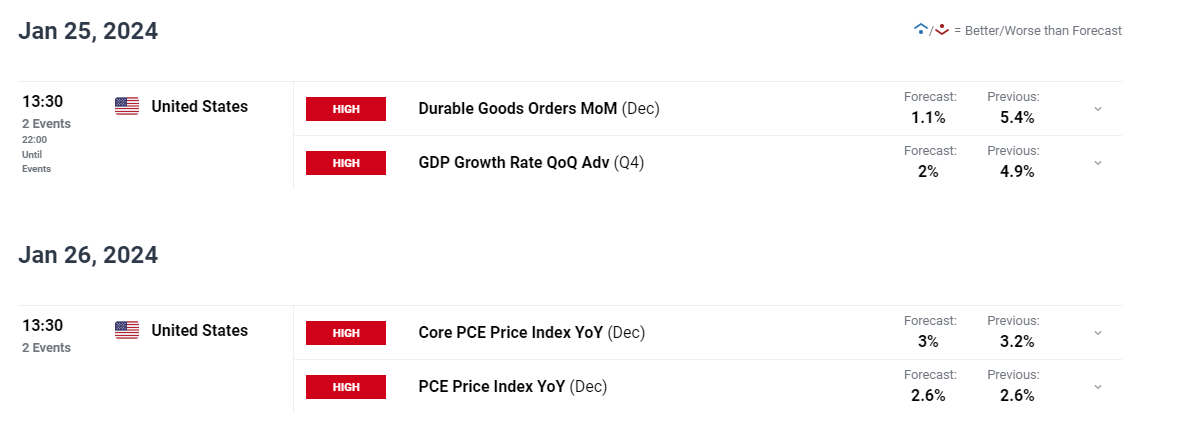

Markets see April as a live meeting for the BoJ but currently price in a full 10 basis points (bps) by the June meeting. The BoJ is primarily looking for the continuation of what it refers to as the virtuous cycle between inflation and wages. The wage negotiation process is likely to roundup in March, which has led markets to naturally look to the April meeting for any movement in the interest rate.

Source: Refinitiv, prepared by Richard Snow

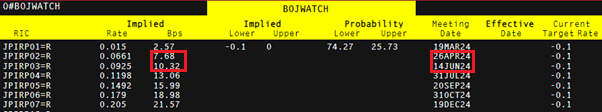

Rising Japanese Bond Yields Spur on The Japanese Yen

Japanese Government bond yields (10-year) continued to rise today, in the aftermath of the BoJ meeting. Yields are still a long way off the early November peak before inflation pressures revealed signs of slowing and markets cooled expectations around any imminent rate changes. The higher yield boosts the attractiveness of the yen and typically sees a rise in the local currency.

Source: TradingView, prepared by Richard Snow

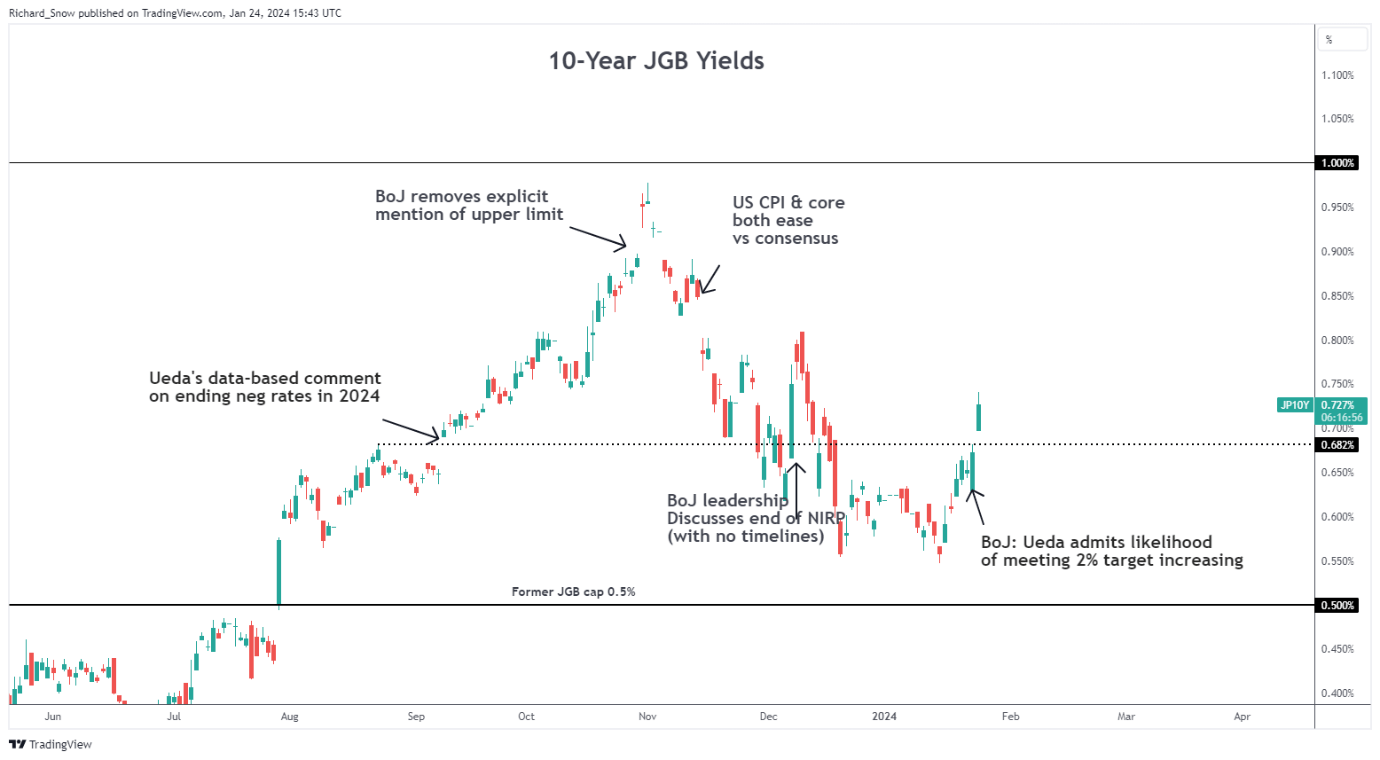

The Yen has broadly risen against a number of major FX currencies ( GBP , AUD , EUR , USD ) as can be seen below in an equal-weighted index comprising of the above-mentioned currencies:

Source: TradingView, prepared by Richard Snow

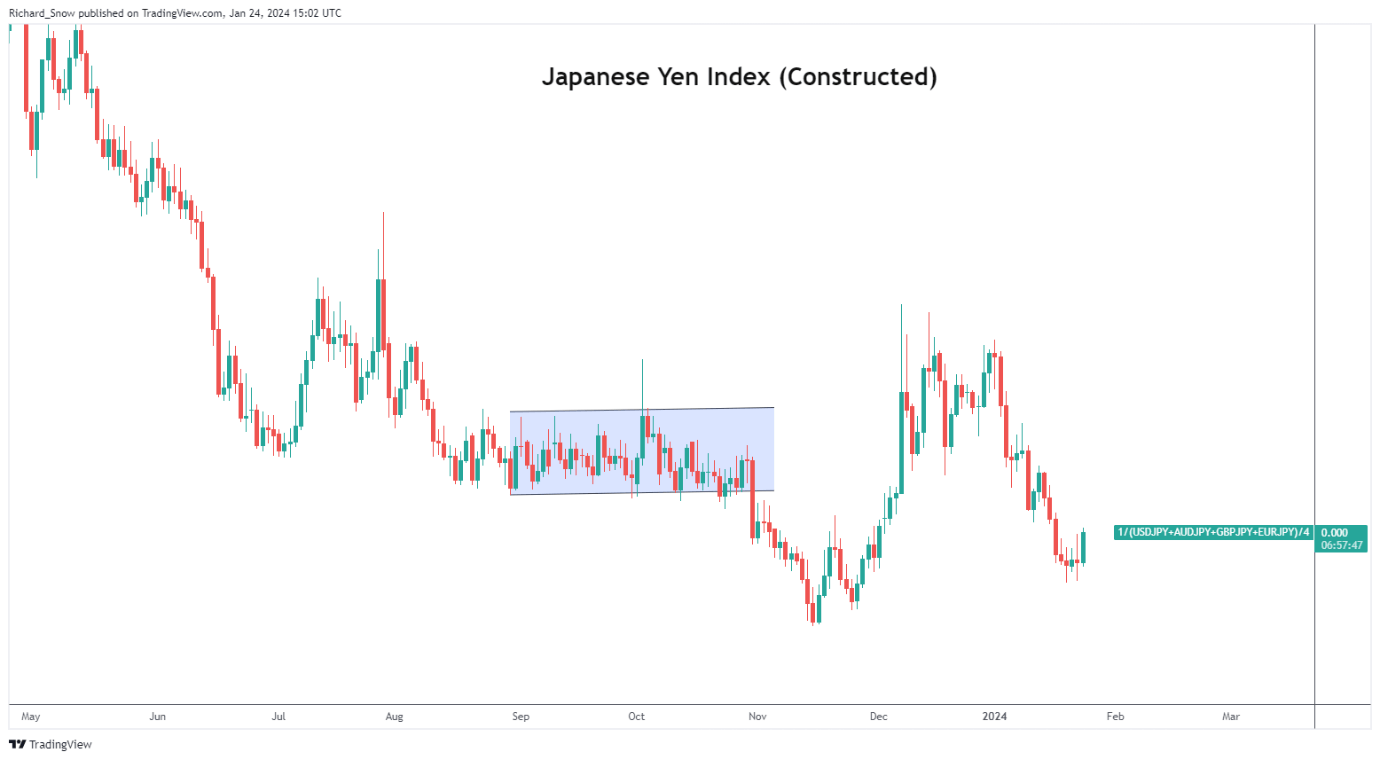

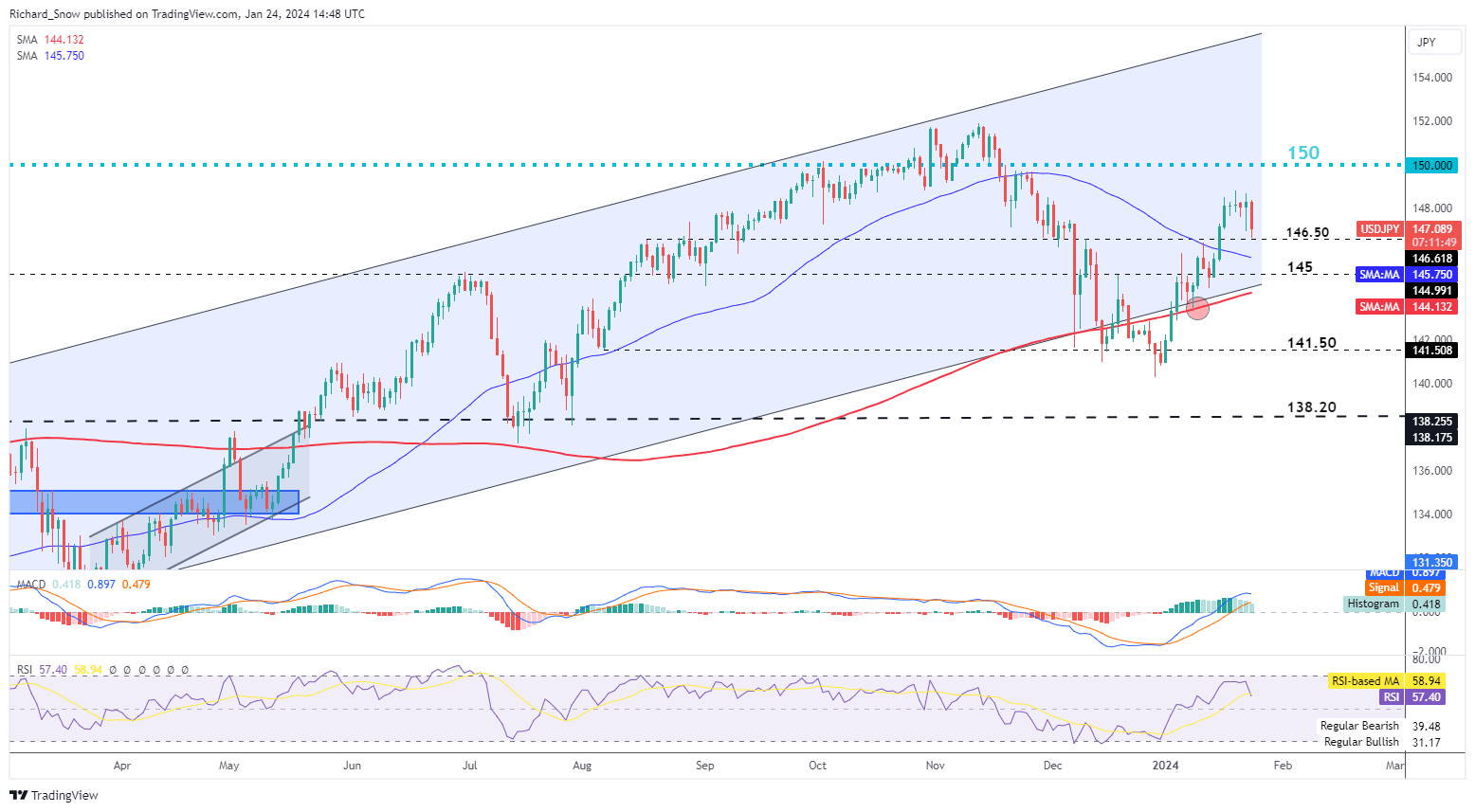

USD/JPY Turns Away from the 150 Mark as 146.50 Emerges as Immediate Support

USD/JPY found resistance ahead of the 150 marker but failed to reach the psychological level after the BoJ head pointed towards an eventual exit from negative rates with increasing probability.

The short to medium term uptrend has not broken down as of yet, with 146.50 the most immediate level of support, followed by 145.00 and the underside of the longer-term rising channel (highlighted in blue). However, the US dollar may pose a challenge to the yen tomorrow and Friday with US Q4 GDP and PCE data on tap.

Strong PMI data earlier today points to an economy that is growing at a decent pace and this could keep USD supported if inflation concerns build in the upcoming data prints with the resilient December CPI print still fresh in the minds of traders.

Source: TradingView, prepared by Richard Snow

After the BoJ meeting, Japan specific data is rather scarce but US Q4 GD and PCE data on Thursday and Friday ought to provide a lift for intra-day volatility before the weekend.

Better-than-expected PMI data for the month of January suggests the US economy is moving along at a decent canter but markets will be more focused on backward looking data in tomorrow’s Q4 growth print.

USD/JPY will also maintain plenty of interest next week when the FOMC meet to discuss monetary policy . Before then, US PCE data for December is expected to reveal stubborn headline pressures remain, with another welcome drop in the core measure of inflation.