Oil (Brent Crude, WTI) Analysis

- US Q4 GDP data could shape the ‘global growth slowdown’ narrative

- Brent crude technical analysis – upside level of interest at $82

- IG Client Sentiment is mixed while longs massively outweigh shorts

The oil market is struggling for direction, which is likely to continue as long as oil fundamentals remain unchanged. Economic forecasts anticipate low global economic growth in 2024 which means oil demand growth is likely to be minimal. This brings about the possibility of an oversupplied oil market which pushes down on prices . Speaking of growth, this week oil (WTI) will be in focus as US GDP data for the 4th quarter is due. The final three months of 2023 are expected to reveal a sharp drop from the phenomenal 4.9% in Q3 (2%).

On the other side of the equation, the current tensions in the Middle East and threat on western shipments making their way via the Red Sea has the potential to jolt prices. However, only around 12% of total global seaborne oil trade goes through the Red Sea meaning a major disruption will be required to materially shift oil prices.

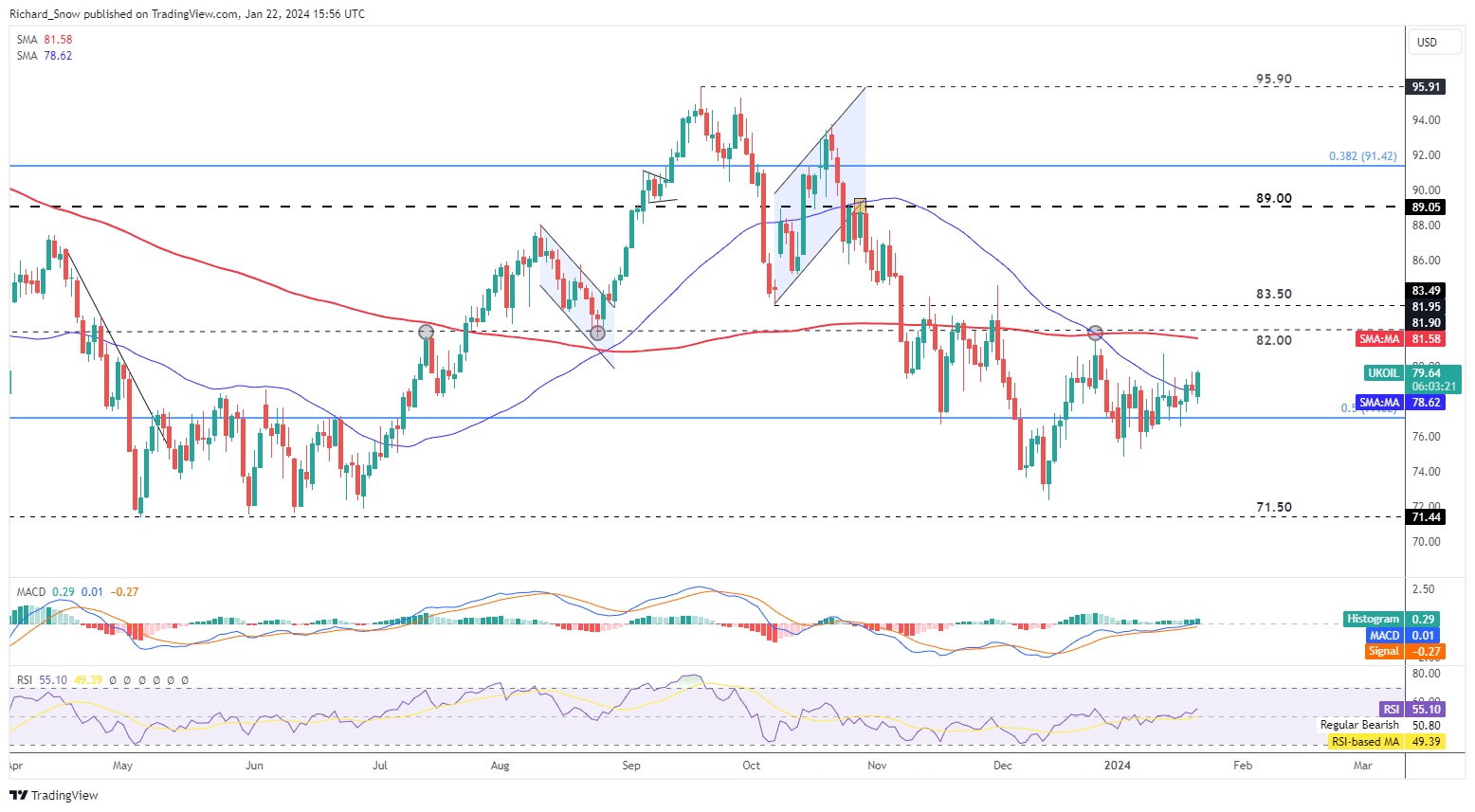

Brent Crude Technical Analysis – Upside Level of Interest at $82

Brent crude oil prices have struggled to really get going, due to the unclear fundamental situation. The MACD points towards a slow and steady rise to the upside, especially after the December 13th swing low. Should the current measured rise extend further, $82 appears as a key level of resistance as the level has proved to be a pivot point in the past. In addition, the $82 level is roughly where the 200-day simple moving average resides. Support is all the way down at the $71.50 level with a less significant $77 emerging as the 50% Fibonacci retracement of the major 2020- 2022 ascent.

Source: TradingView, prepared by Richard Snow

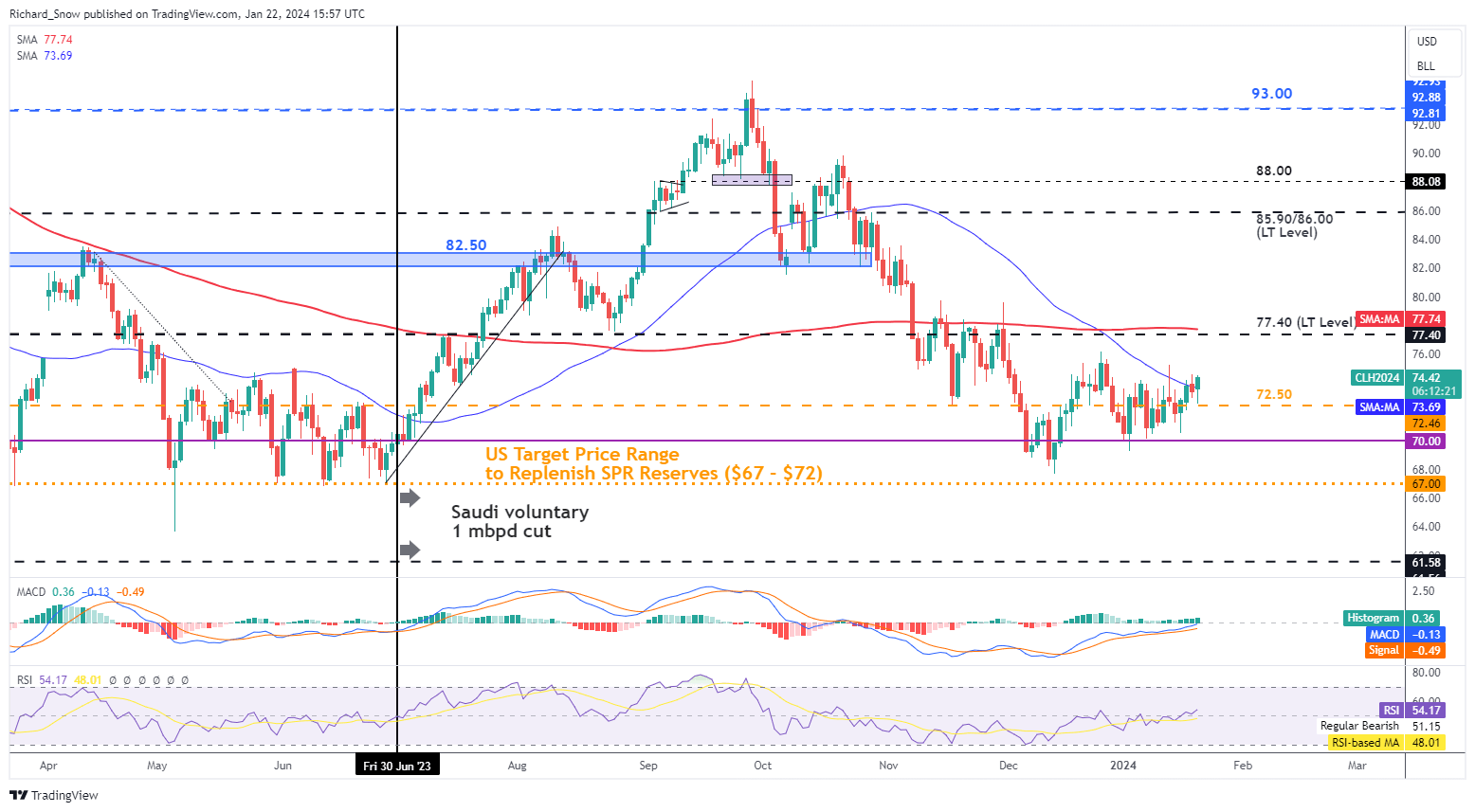

WTI Faces Resistance Ahead of Significant $77.40 Marker

WTI oil prices successfully navigated the $72.50 test, opening up a return to the significant long-term level of $77.40 – which coincides with the 200-day simple moving average. The lift in prices since the swing low continues with trepidation, lacking conviction. $72.50 appears as near-term support.

Source: TradingView, prepared by Richard Snow

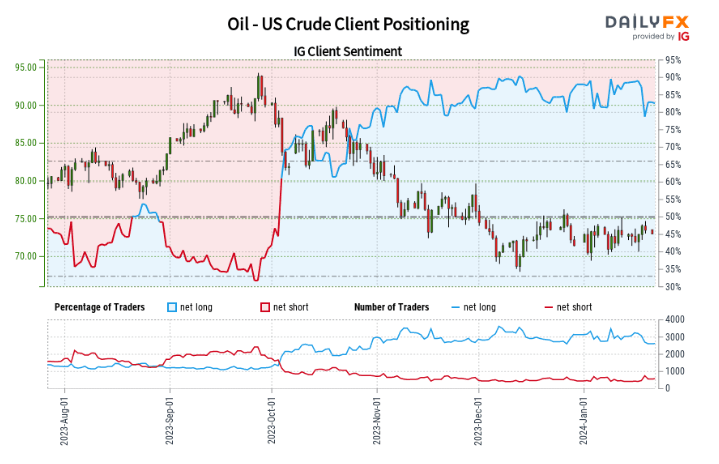

IG Client Sentiment ‘Mixed’ While Longs Massively Outweigh Shorts

Source: TradingView, prepared by Richard Snow

with the ratio of traders long to short at 4.94 to 1..

, and the fact traders are net-long suggests Oil - US Crude prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further

Read the full client sentiment report for the daily positioning developments were essential in arriving at the ‘mixed’ trading bias.